Will There be More EIDL Funding?

The SBA's Economic Injury Disaster Loan (EIDL) program – and others – have helped millions of businesses survive and recover from the Covid-19 pandemic. A new study by Goldman Sachs indicates that small businesses are in favor of more government funding for small businesses – as Omicron continues to impact revenue. Here's what you need to know.

Government Funding Has Helped Millions of Businesses to Date

Since the beginning of the pandemic, the SBA has helped millions of small businesses through the Shuttered Venue Operators Grant (SVOG), the Restaurant Revitalization Fund (RRF), the Paycheck Protection Program (PPP), and the Economic Injury Disaster Loan (EIDL) program.

The PPP and EIDL programs have helped the most small businesses. The SBA has forgiven just over 9.6M PPP loan applications for a total of $692B. The EIDL program has awarded over $329B in loans and just over $7B in Targeted and Supplemental Advances.

The EIDL program lasted the longest – but it too closed in December of 2021. There has been no talk of additional funding – until now.

Survey Shows a Majority of Small Businesses Support Additional Funding

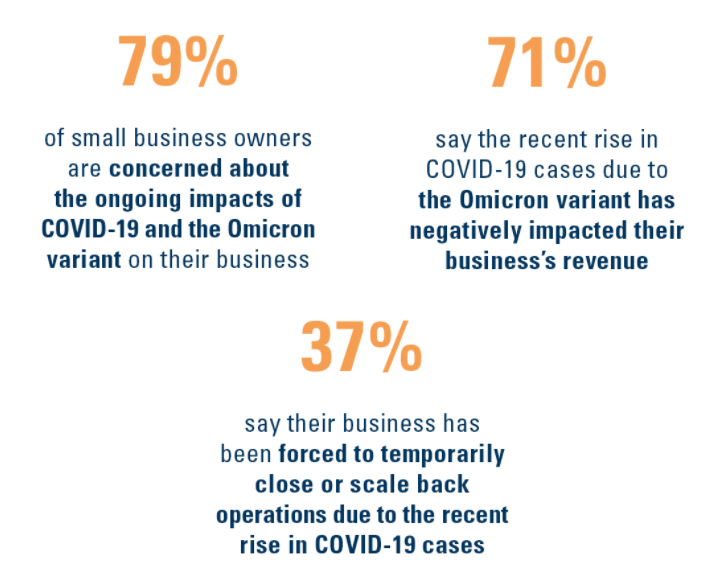

The survey conducted by Goldman Sachs highlights the current experience and position of small businesses. Over two-thirds of businesses surveyed – 71% to be exact – reported being negatively impacted by the Omicron variant while 37% have been forced to close or reduce operations.

Additionally, 79% are concerned about the future impact the pandemic will have on their business.

Aside from pandemic-related difficulties, small businesses are increasingly facing other obstacles – such as labor force and supply chain challenges, as well as inflation. 87% of small businesses that are actively hiring are finding it difficult to attract qualified candidates. Almost every actively hiring business – 97% to be exact – reported that the inability to hire the right employees is affecting their revenue.

Regarding the supply chain, 69% of businesses state that their bottom line has been impacted by supply chain disruptions and delays, and 76% report that their business has been negatively impacted by inflation over the past six months.

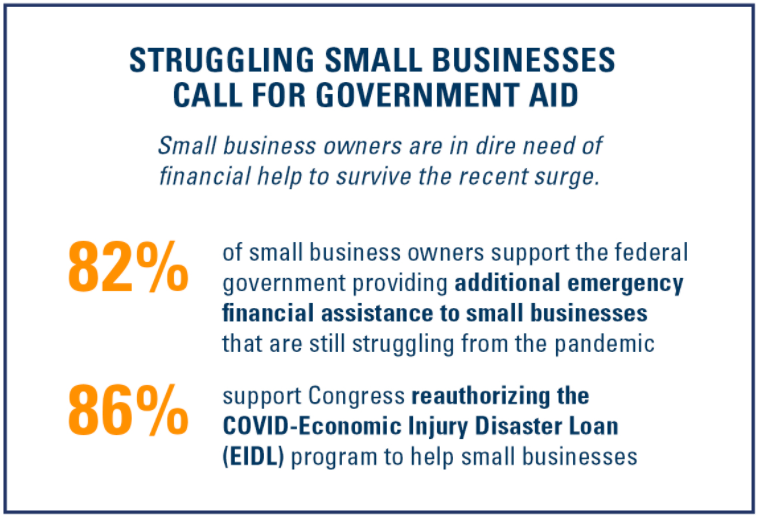

All of these reasons – and likely more – have led small businesses to support additional funding from the federal government. According to the study, 82% of business owners support the government providing additional emergency funding and 86% support the reauthorization of the EIDL program specifically.

Now May or May Not Be Ideal for Additional Government Funding

Small businesses are overwhelmingly supportive of the federal government allocating more funds for small businesses – especially with Omicron hampering growth. Those that argue against additional funding point to several factors, such as the national debt – which stands at just over $30 trillion – and inflation.

Inflation is at a 40-year high and the price of goods – from gasoline to housing and everything in between – is affecting small businesses and consumers alike. Opponents of additional stimulus or government funding argue that more money in the economy – while temporarily beneficial for small businesses – will only add to the national debt and exacerbate inflationary pressures in the long run.

Get Funding Help for Your Business

Do you need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.