The Ultimate Guide to SBA Loans

As the EIDL program comes to a close, many small businesses still need funding as they continue to recover from the COVID-19 pandemic.

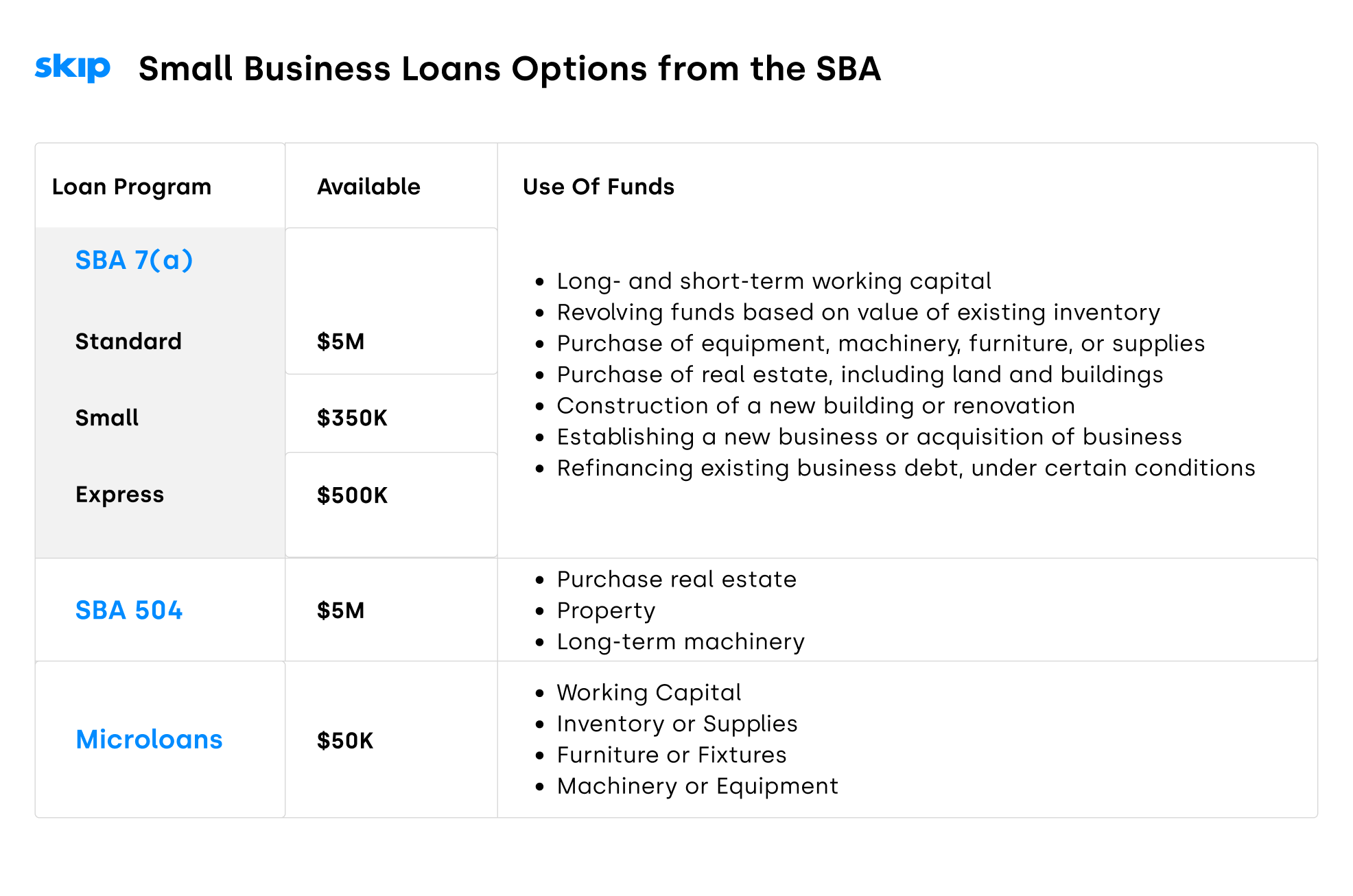

The U.S. Small Business Administration (SBA) offers many great options beyond EIDL, including the 7(a), 504, and Microloan programs. We're here with the highlights of each program to help you make the best decision for your business.

Here's what we'll cover:

Do You Have to Pay Back SBA Loans?

As always, if you have questions about these programs, our team of experts can meet with you 1 on 1 to determine the best option for your business. Each program is slightly different – here’s a quick overview. Read on below for the details on each program.

What Is An SBA Loan?

SBA loans are loans that you can get from virtually any bank or lending institution, that are guaranteed by the US government – kind of like student loans. SBA loan are designed to make growth more accessible to bootstrapped small business owners, with low interest rates and flexible payment terms.

Do You Have to Pay Back SBA Loans?

It's a fair question – the PPP program allowed for loan forgiveness, and if this was your first experience with an SBA loan, it may leave you wondering if any other SBA loans are eligible for forgiveness, too.

But unlike the PPP program, other SBA loans do have to be paid back.

Types of SBA Loans

Apart from the EIDL and PPP loans, there are three other loan programs currently offered under the SBA. You can scroll down for all the details on each program.

- SBA 7(a)

- SBA 504

- Microloans

What is an SBA 7(a) Loan?

The SBA’s 7(a) loan program is a partnership with lenders. The SBA incentivizes lenders to offer greater access to capital at lower interest rates and with better repayment terms. Lenders are guaranteed up to 90% repayment with an SBA loan if a small business defaults, to incentivize the offering.

Requirements for SBA 7(a) loan

As a business owner, you can use your 7(a) loan for a variety of business-related purposes, including:

- Creating or acquiring a business

- Making equipment purchases

- Purchasing real estate land or structures

- Constructing new facilities, renovating, or expanding existing buildings

- Refinancing or consolidating existing business debt (restrictions may apply)

There are three types of 7(a) loans: Standard, Small, and Express.

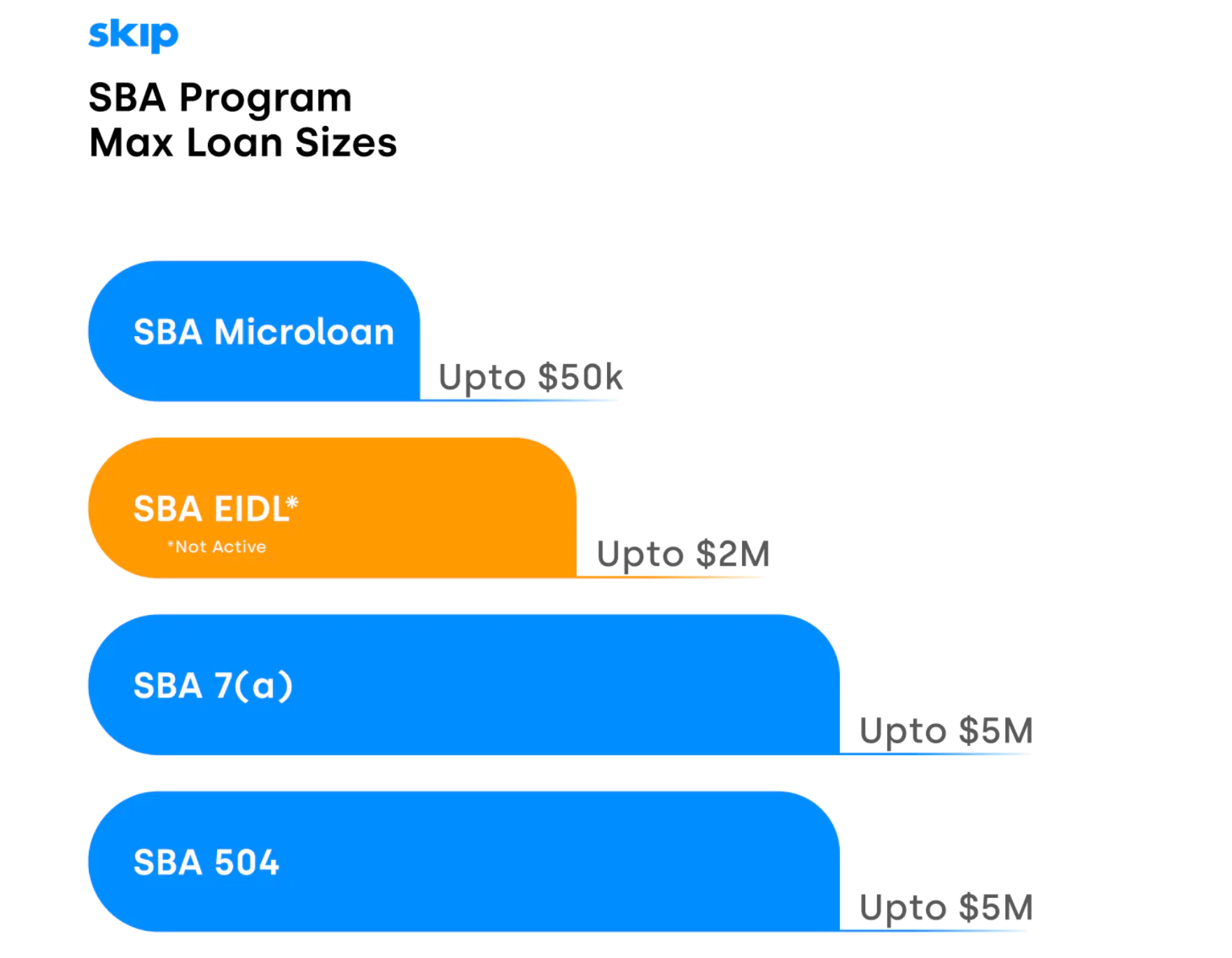

Standard 7(a): The maximum loan amount for a Standard 7(a) Loan is $5 million. Key eligibility factors are based on what the business does to receive its income, its credit history, and where the company operates.

7(a) Small Loan: The 7(a) small business loan is essentially the same as the Standard 7(a), just smaller. While it does have similar rates, terms, and guarantees, it is capped at a maximum loan amount of $350,000.

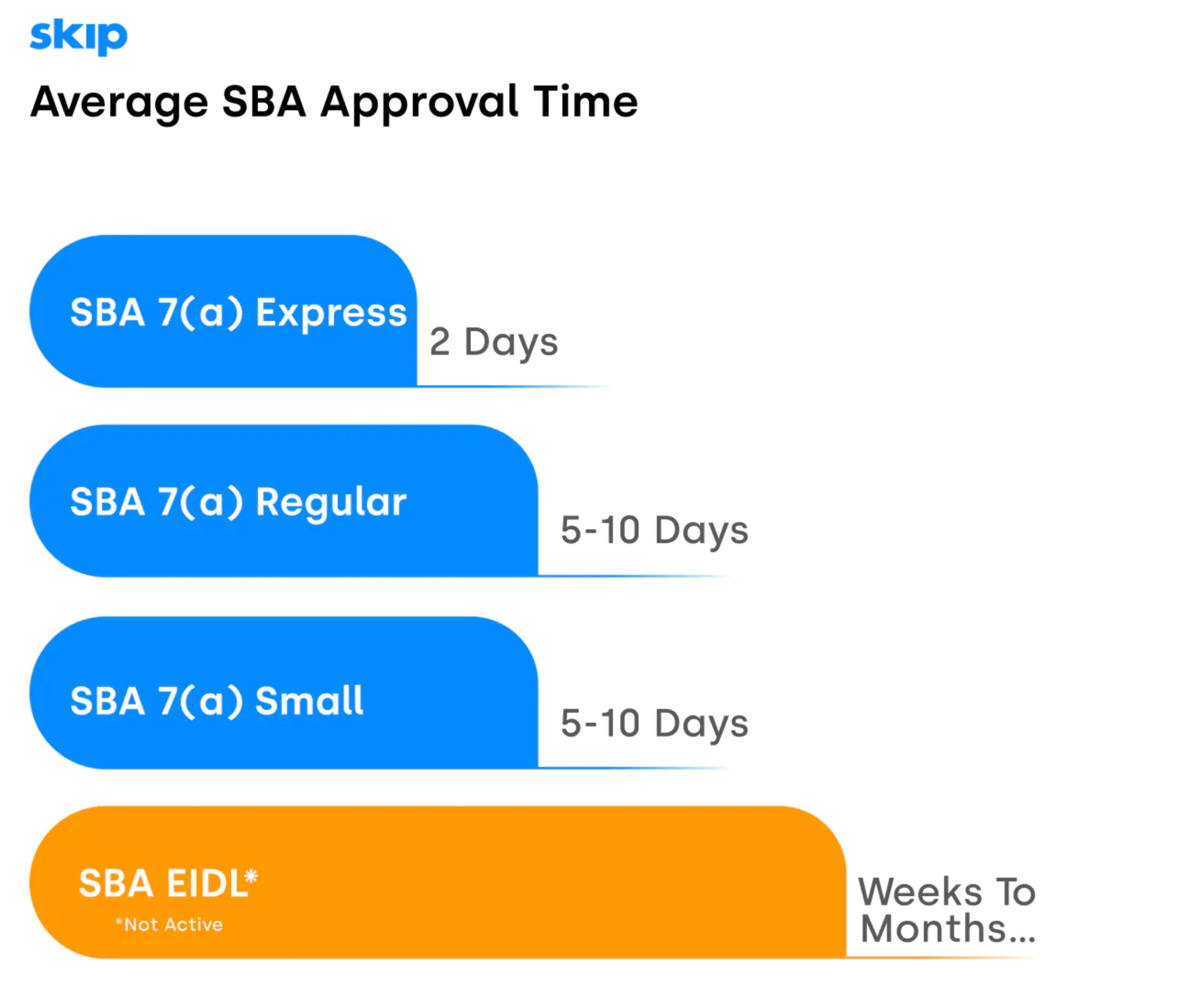

SBA Express: The SBA Express loan is similar to the Standard and Small 7(a) loan programs, but it has a noticeably shorter turnaround time, plus collateral and guarantees differences. The Express loan boasts a very quick 36-hour turnaround time from the SBA, and is capped at $500,000. Unlike the Standard and Small loans’ 90% guarantee, SBA Express loans are only guaranteed at 50%.

The 7(a) SBA loan program is one of the best financing sources for small businesses. They're affordable, typically come with generous terms, and can be easier to obtain than traditional loans. However, that doesn't mean they're perfect. Other business funding sources may be more affordable, with more accessible, faster application processes and more lenient prerequisites. It's important to note that you won't get approved for a 7(a) loan if you can't prove that you've been declined for other types of financing, so you may need to pursue those options first.

How Long Does it Take to Get Approved for a 7(a) Loan?

As you can see below, the 7(a) programs can move much more quickly than the EIDL applications many of you are familiar with. This makes the 7(a) an appealing option for businesses who need funding now.

If you’re considering applying for a 7(a) loan, we recommend you book a call with our team of expert Funding Concierges to determine your best path forward.

Book a Call with a Funding Concierge

What is an SBA 504 Loan?

If your business is looking to purchase real estate, property, or even long-term machinery, the SBA’s 504 Program may be your best option. Eligible businesses can get up to $5 million in funding.

Unlike the 7(a) loan programs, all 504 loans are only available through Certified Development Companies (CDCs), the SBA's community-based partners. CDCs are certified and regulated by the SBA; they regulate nonprofits and promote economic development within their communities.

How Do SBA 504 Loans Work?

SBA 504 loans are structured differently than other SBA loan programs. It's essential to understand that 504 loans are composed of three distinct parts:

- the lender

- the Certified Development Company (CDC)

- the borrower

In most cases, SBA 504 loans are structured in a 50-40-10 model.

First is the bank loan, which is 50% of the total amount. Second is a CDC, which provides 40% of the total loan amount. Third is the borrower, who provides a 10% down payment. New businesses that have been in operation for less than two years and special-purpose properties are required to provide an equity amount of 15%, creating a 50-35-15 structure. If a borrower happens to be both a new business AND a special purpose property, the equity requirements change to 20%, following a 50-30-20 model.

While the 504 loan program does have a wide range of requirements, almost all small businesses in the US will qualify for the program as long as they’re past the beginning planning stages.

SBA 504 loans offer longer amortization periods (10, 20, or 25-year terms depending on what is being financed), allowing you to spread your payments over a more extended time period to reduce the amount you pay each month.

Conventional loans require paying around 1% of the loan's value out of your pocket in fees. Even 7(a) loans require paying between 2% and 3.75% of the loan amount out of pocket. The 504 loan stipulates that you’ll pay a maximum of 2.65% of the loan's value in fees. Still, those costs are included in the loan amount, meaning that you have only the down payment for out-of-pocket expenses.

Please Note: While the 10% down payment can be nerve wracking, most CDC organization will deduct your down payment from the funds that you are approved for. In addition, collateral for the loan is secured with the property or equipment you are purchasing, leaving no need for additional collateral for your loan in most cases.

The Potential Downsides to a 504 Loan

While plenty of benefits makes a 504 loan appealing, there are a few drawbacks that you should know about before deciding on a funding solution. The 504 loan program is more paperwork intensive, requiring documents about your business, finances, personal information, and insurance.

It’s fair to say the 504 program is not the most streamlined in the world, primarily due to the need to have three parties involved. It's not just you working with a lender, as with a conventional loan. Both the CDC and the lender must agree on terms and ensure that they comply with SBA requirements.

From the outset, it should be noted that SBA real estate loans are not fast. In contrast to a home mortgage loan, which might close in just 30 days, it often takes around 60 to 75 days to close on an SBA real estate loan and receive your funding.

Not sure if a 504 loan is right for your business?

If you have questions about applying for a 504 Loan for your business, our expert team of Funding Concierges is here to help.

Book a Call with a Funding Concierge

What is an SBA Microloan?

The SBA's Microloan program provides loans up to $50,000 to help small businesses start and expand. The average Microloan is about $13,000.

The SBA provides funds to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending, management, and technical assistance. These intermediaries administer the Microloan program for eligible borrowers.

Requirements for Microloans

Unlike many traditional loans, SBA microloans are available to small business owners with no credit history and/or lower incomes. The program is geared toward businesses otherwise underserved by traditional banks, including women- and minority-owned businesses and those in low-income communities. Microloans are available to small businesses and specific not-for-profit childcare centers.

Microloans can be used for:

- Working capital

- Inventory or supplies

- Furniture or fixtures

- Machinery or equipment

Note: Proceeds from an SBA microloan cannot be used to pay existing debts like delinquent taxes, including Federal, state, or local payroll taxes, sales taxes, similar taxes, or to purchase real estate.

Is a Microloan the Right Move For You?

The main advantage of SBA Microloans is that they provide funding to businesses that typically don't qualify for a standard small business loan. This includes startups, business owners with less-than-ideal credit, and those in underserved communities. SBA Microloans also have low fees, competitive interest rates, and extended repayment terms.

The downside of SBA Microloans is that they're small-dollar business loans. If you need more than $50,000 to grow your business, you may need to look elsewhere. Similar to the 7(a) program, you will need to prove you’ve been previously declined for other types of financing.

Alternatives to an SBA Microloan include other nonprofit microlenders, invoice financing, and traditional term loans from banks and online lenders. In general, online lenders and microlenders are more likely than banks to lend to newer businesses or those without excellent credit.

Get Help for Your Business

Need help getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team.

Join Skip VIP today for 1-1 support

How Else Can Skip Help?

Get help funding your small business, finding and applying for grants and SBA loans, enrolling in TSA PreCheck, setting DMV appointments, and so much more. We'll stand between you and the long hold times. Skip the red tape – sign up today to get support.