Targeted Advance Reconsiderations Due February 15th

The deadline to apply for the Targeted Advance has already passed – this is a deadline for business owners who've been denied before. If you applied for the EIDL Targeted Advance – and were denied, you have until February 15th to apply for reconsideration (also called reevaluation). Here's what you need to know.

📌 Pro-tip for more grant funding: Want help applying for other grants or loans? Book a time to talk with us and become Skip Premium. Use this link to get 1 additional month added for free. Spots to help with this grant are limited.

Targeted Advance Reconsideration Deadline is Feb. 15th

The SBA announced the final deadline for all Targeted Advance reconsiderations. If you already applied for the Targeted Advance (deadline was December 31, 2021) and were denied, then you only have a few more days to submit your reconsideration.

The SBA press release states, "This opportunity is for small businesses that were declined for the Targeted Advance program and can provide additional information to demonstrate their eligibility."

If you believe that you qualify for the Targeted Advance, send an email to TargetedAdvanceReevaluation@sba.gov. In this email, explain clearly – with applicable documents – why you qualify for the Targeted Advance. As a reminder, here are the Targeted Advance qualifications:

- Your business must have fewer than 300 employees

- You must demonstrate a 30% reduction in revenue compared to the previous year. The reduction in revenue can be over any eight-week period of time starting March 2, 2020.

- Your business must be in a low-income area

You can also call SBA’s Customer Service Center at 1-833-853-5638.

SBA Continues to Process EIDL Reconsiderations, Appeals, and Increases

The deadline to apply for Targeted Advance reconsideration is February 15th, but the SBA will continue to process EIDL reconsiderations, appeals, and loan increases.

If your EIDL application is denied, you have six months from the date of denial to request a reconsideration. If you receive a denial on March 1, 2022 – for example–you have until September 1, 2022, to request a reconsideration.

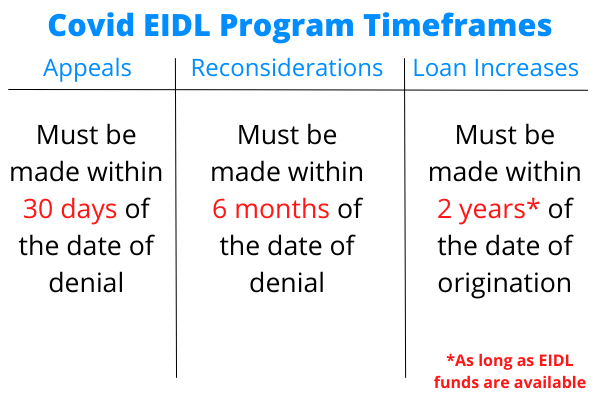

Furthermore, businesses have two years from the origination date to request an increase. Appeals are more time-sensitive – they must be made within 30 days of the date of decline. Below is a chart illustrating the different EIDL loan timeframes.

Remember, the longer you wait, the more likely the SBA is to run out of funds. If you know you want to request an increase, do it right away.

Be Part of the Largest EIDL Survey in the U.S.

We are undertaking the largest EIDL survey in the U.S. We want to showcase the positive impact that the EIDL program had – and continues to have – on small businesses across the U.S. Additionally, there is little information on the average EIDL loan size and – more importantly – how businesses are using their EIDL funds.

We invite you to partake in this quick survey – no matter where you are in the EIDL process.

Get EIDL and Other Funding Help for Your Business

Do you need help with your EIDL application or getting other funding for your business? We can help you with EIDL, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.