SBA Sends EIDL Program Update

On Wednesday April 20, the SBA sent existing EIDL borrowers an email updating them on important EIDL loan increase and EIDL repayment information. Here's the recap of the email with screenshots below, especially important if you're an existing SBA borrower.

EIDL Funding Is Indeed Running Out

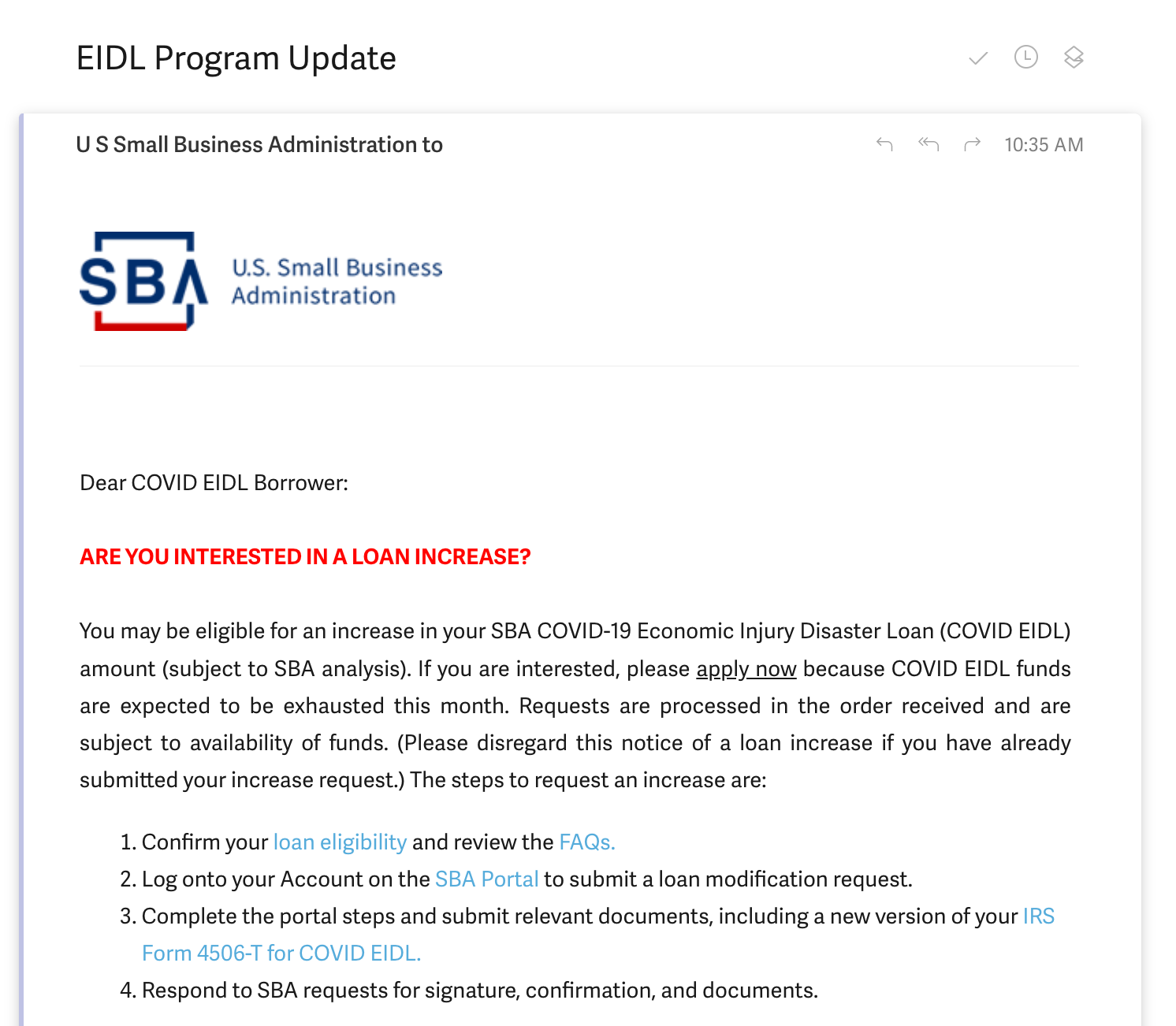

We've been tracking the dwindling EIDL funding with our countdown timer for months. Yesterday, the SBA sent a final reminder to EIDL borrowers: If you want an increase, now is the time to apply. Here is the first part of the email.

Here's the important text and links from the EIDL update email:

You may be eligible for an increase in your SBA COVID-19 Economic Injury Disaster Loan (COVID EIDL) amount (subject to SBA analysis). If you are interested, please apply now because COVID EIDL funds are expected to be exhausted this month. Requests are processed in the order received and are subject to availability of funds. (Please disregard this notice of a loan increase if you have already submitted your increase request.) The steps to request an increase are:

Confirm your loan eligibility and review the FAQs.

Log onto your Account on the SBA Portal to submit a loan modification request.

Complete the portal steps and submit relevant documents, including a new version of your IRS Form 4506-T for COVID EIDL.

Respond to SBA requests for signature, confirmation, and documents.

The SBA Has EIDL Repayment Updated Information Coming

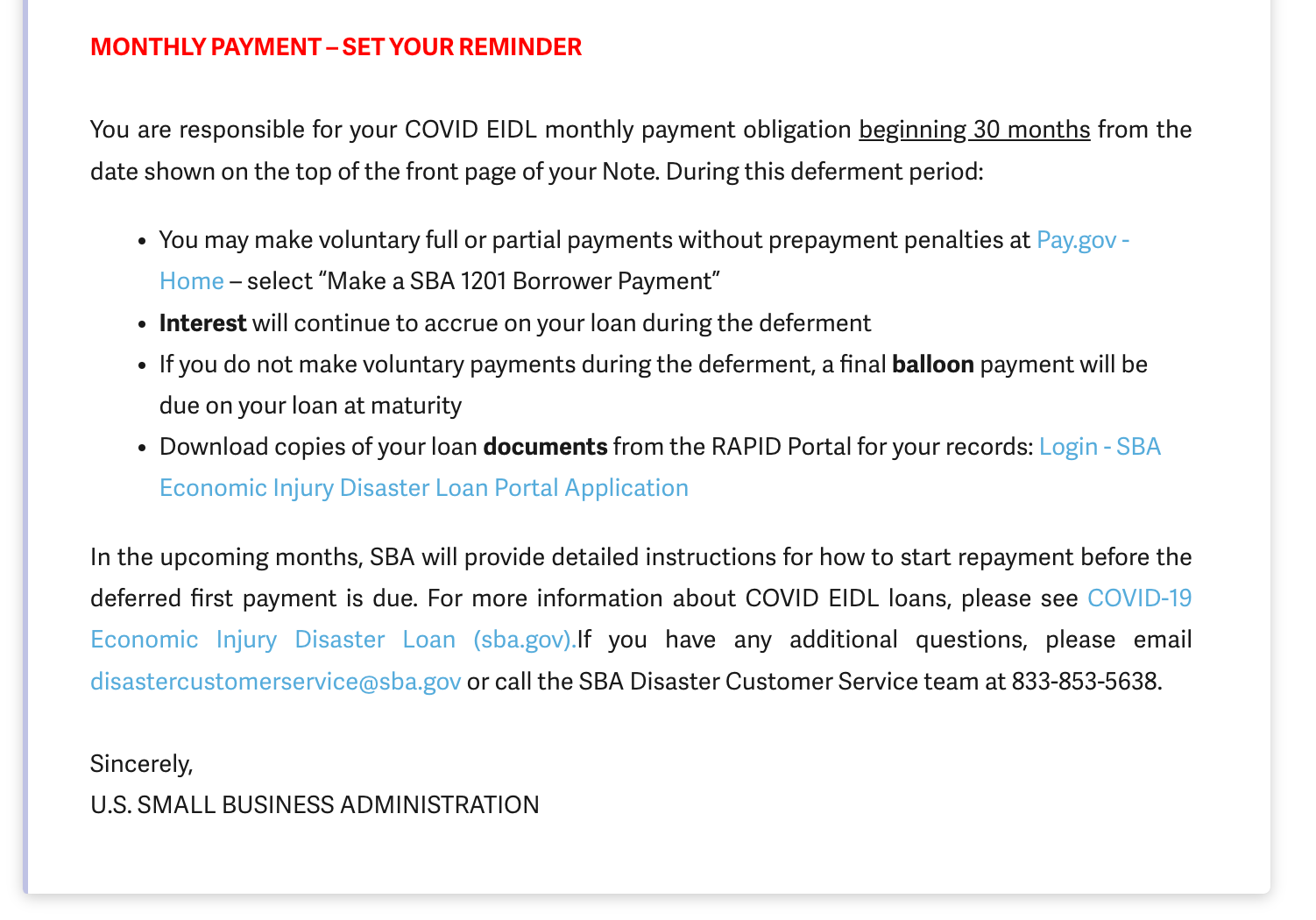

Also in the SBA email was a monthly EIDL payment reminder and how to pay back your EIDL loan. As a reminder, the deferment period is now 30 months from loan origination date — so for most borrowers, first payments aren't due until November or December of 2022.

However, interest is still accruing. You can make early payments without pre-payment penalties. Here's the second part of the email.

If you're interested in finding out your existing EIDL balance with the SBA or other outstanding debts with the SBA, you can login to their system at EIDLPay.com. You can make payments at Pay.gov.

Want Funding Help for Your Business?

Do you need help getting funding for your business? Skip can help with SBA loans and lines of credit, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip VIP today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.