Over 35% of PPP Recipients Still Need to Apply for Forgiveness

In August, the Small Business Administration (SBA) released their Paycheck Protection Program (PPP) direct forgiveness portal, but many businesses have not applied. Recent data illustrates that over 35% of businesses still have not applied for PPP forgiveness. In this post, we will discuss the most recent PPP data and briefly review how to apply.

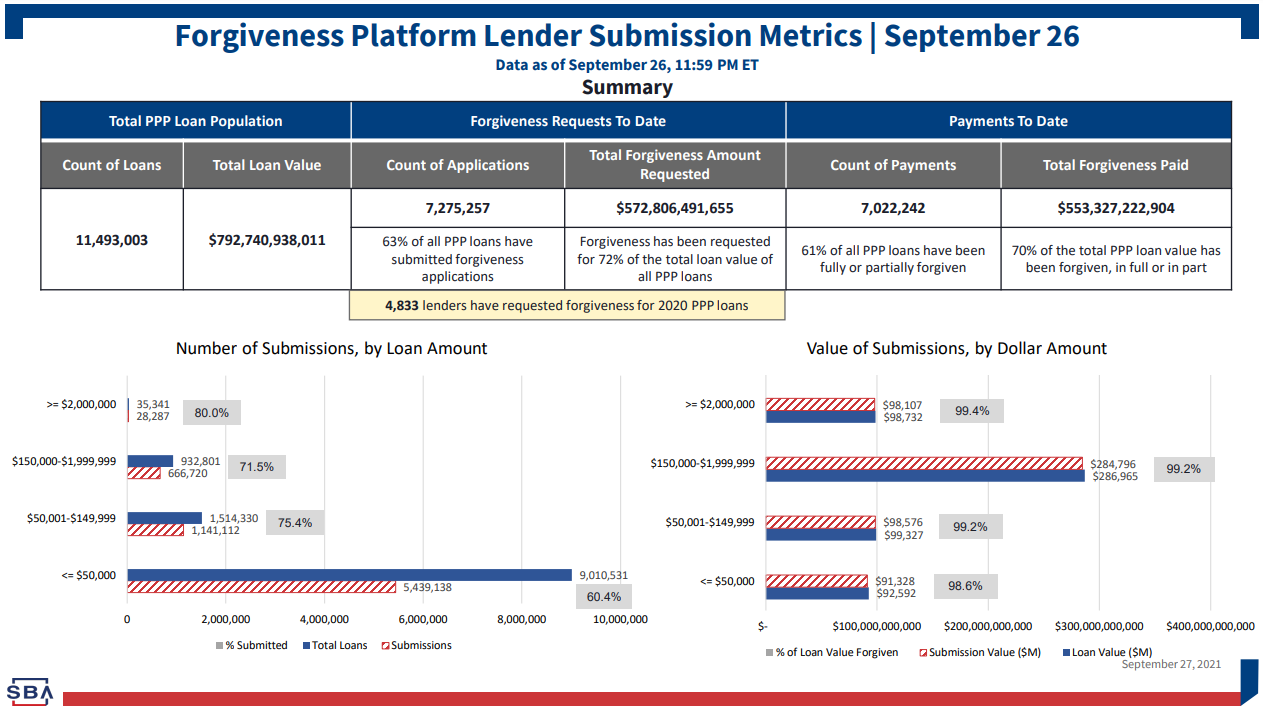

37% of PPP Borrowers Have Not Applied for Forgiveness

Sunday, the SBA released the most recent PPP metrics. The SBA has issued just under 11.5 million PPP loans to businesses, totaling nearly $800 billion. Of these loans, 7.28 million (or 63%) have petitioned for forgiveness and 7.02 million (61%) have been granted forgiveness. That means that there are still over 4 million businesses (37%) who have received a PPP loan and have not applied for forgiveness.

64% of the businesses that have received forgiveness are PPP applicants from 2020. Of the 5.1 million PPP loans issued in 2020, 4.57 million (89%) have been fully or partially forgiven. Only 42% of PPP borrowers from 2021 have applied for forgiveness.

More Lenders Are Participating in Direct Forgiveness Portal

When the SBA announced the opening of their direct forgiveness portal, only 600 lenders were participating. Lenders must opt-in for borrowers to file for forgiveness using the SBA PPP Direct Forgiveness Portal. As of September 26, 2021, over 1,400 lenders are participating.

If you want to check if your lender has opted-in to the direct forgiveness portal, you can search the list of participating lenders compiled by the SBA. If your lender still has not opted-in, you can request that they do so. It will save you and your lender time. Otherwise, you will need to file for PPP forgiveness through your lender.

Make Sure You Qualify For PPP Forgiveness

Before you apply for PPP forgiveness, make sure that your expenses are forgivable. Your PPP loan can be forgiven if employee compensation levels were maintained, 60% of your loan during the 8-to-24 week covered period was spent on payroll costs (including wages, vacation pay, etc.), and the remaining 40% was used for other eligible expenses. Here is a list of other eligible expenses:

- Interest payments on most business loans (incurred before February 15, 2020)

- Rent or mortgage (in effect by February 15, 2020)

- Utility payments

- Supplier costs that are essential to operation

- Operation expenses, such as business software necessary to run and account for business transactions

- Property damage not covered by insurance and that occurred as a result of public disturbances in 2020

- Worker protection expenses such as personal protection equipment or business improvements to comply with Covid protocols and ordinances.

How to Apply For PPP Forgiveness

Borrowers can apply for forgiveness once the forgivable portion of their PPP loan is spent and up to the maturity date of the loan. If you do not apply for forgiveness within 10 months after the last day of your covered period, you must begin making loan payments.

If your lender is not participating in SBA direct forgiveness, you must apply for forgiveness through your PPP lender. If your lender is participating, head to the SBA PPP Direct Forgiveness Portal and begin the application.

Get Personalized Assistance For Your Funding Situation

If you have questions with your PPP application, EIDL application, or any other question, get ongoing personalized funding help from our team. There are over 2,000 on our waiting list. You can skip the waiting list completely with this invite link, exclusive to our readers.