How to Start a Business In 2022: Roadmap For Success

If you’re ready to capitalize on your expertise, talent—or interests—and become your own boss, we’ve provided a comprehensive roadmap to steer you in the right direction as you begin.

In this article, we’ll cover business entities and business models, and why you need to choose when starting out. Where to find market research to look for problems that need solving, why you need a business plan, and information about estimating the costs to start a business.

Lastly, we’ve provided links to reputable lenders specializing in small business funding—to help get your dream off the ground.

What Kind of Business Should I Start in 2022?

There are countless types of businesses—and just as many reasons to start your own, beginning in 2022. This might be the easiest—or toughest—question to answer. Start by examining your interests, expertise, or other well-defined objectives that solve a problem for individuals and businesses.

Do Your Research

Understanding the market conditions for any type of business is crucial—especially one in its nascent stages. Take the time to thoroughly research your market to gain invaluable insight into its potential—or limitations.

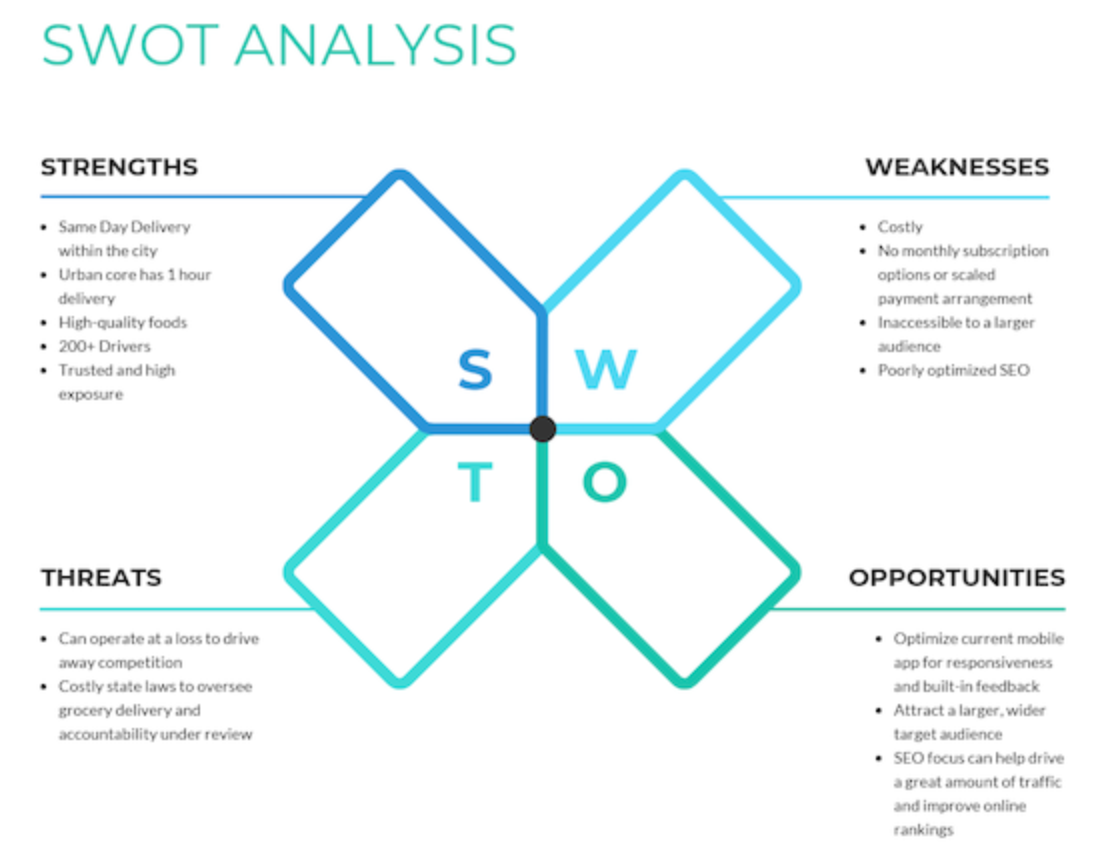

Use a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to help determine the viability of your business and how to prepare for the competition.

For example, if you plan on opening a bicycle shop, and there are several other bike shops within walking distance or yours, they are a "Threat" to your business.

You might choose to find another, less competitive location. Or differentiate yourself with unique offerings and services. Strengths that appeal to a niche market, like elite triathletes or endurance athletes.

Name Your Business

You’ll need to come up with a moniker for your new business, and using your own name is ok. However, you’ll also need to check if your Doing Business As or DBA name is available in your state.

Businesses in different states can have the same name, but if the name you choose is already in use by another company in your state, you’ll need to rename yours. To search for registered business names in your state, visit the Secretary of State’s website.

Determine Your Business Entity Type

Each type of business entity has its advantages and disadvantages, including set-up costs, taxation requirements, and liability exposure. However, most businesses fall into one of these categories:

- Sole Proprietorship

The most common type of business provides managerial control of a business, but no protection against personal liability. The simplest and least expensive business to establish. - Limited Liability Company (LLC)

An LLC is a hybrid business entity that combines the simplicity of a Sole Proprietorship with the liability protections and tax benefits afforded Corporations. An LLC protects its owners from personal liability, including debt from the business. Requires Articles of Organization filed with the state. - Corporation

A Corporation generally consists of a group of Shareholders who remain separate from the business for taxation and liability purposes. Also requires regular annual meetings, a board of directors, and a senior management team, and Articles of Incorporation filed with the state. - Partnership

A Partnership is a business relationship between two or more people. Each partner contributes—and shares in the profit, risk, liability, and losses. Requires Partnership Agreement registered with the state.

Choose Your Business Model

There’s no shortage of the types of business to start, however, it’s important to understand the business model you’ll be basing yours on. What do we mean by business model? Simply, it’s the way you operate or structure your business—and how you plan to make a profit.

Here are examples of the different types of business models, and who they might apply to.

A nutritionist, executive coach, financial advisor, or other individuals with highly specialized, and sometimes licensed skills, are most likely a Consultancy model.

You’re a software engineer who specializes in payroll services for restaurants. Your Software as a Service (SaaS) business generates recurring revenues from client subscribers who license its use.

An Affiliate Marketing model generates commissions/revenue for click-throughs (CTs) or actual sales for promoting their affiliate’s goods or services from their sites.

Perhaps you’re an educator who wants to sell your ebooks, online courses, or other instructional materials. Your business model falls under Information Products.

The Freelance Model covers individuals who provide a specific set of immediate or ongoing skills to businesses and individuals. Writers, web developers, or graphic designers, to name a few would be considered freelancers.

With the advent of the internet, eCommerce is quite possibly the most common business model. Revenues are generated by selling physical products through the internet. Sites like Shopify have made starting an eCommerce business exceedingly easy.

Write a Business Plan

Writing a business plan is an excellent way to organize your thoughts into actionable steps—and clarify your goals. Moreover, if you plan on seeking funding, your business plan can help you present yourself as more creditworthy.

Your business plan should contain the following:

- The “Elevator Pitch”

A brief synopsis of what your business does, and the problem it solves. - Target Audience/Market Defined

If you're a nutritionist, your target audience might be pregnant women, or people dealing with diabetes, seeking guidance on specialized diets. - SWOT Analysis

The SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis shows you’ve explored all angles of your business and understand the risks and rewards. - Marketing Plan

This is how you’ll describe your approach to promoting, branding, and marketing your business. - Financial Plan Projections

An explanation of how you plan to pay to get the business started, how you’ll generate revenue, a listing of your business’s costs. - Financial Projections

Financial projects by quarter, e.g. Q1: January to March, Q2: April to June, etc.

Get SMART

From the moment you had the epiphany to start your business, there are many paths. Many of them are winding…and unproductive. If you’re just starting in business, you’d be wise to curb your enthusiasm and get SMART.

Compiling your SMART goals should be one of the first exercises in developing your business. This list of goals will help you focus on what is important first, to achieve long-term goals.

- S-Specific

Unambiguous and well-defined. - M-Measurable

Must meet specific criteria. - A-Achievable

Attainable, and not impossible. - R-Realistic

Goal is within reach and realistic. - T-Timely

Clearly defined timelines and deadlines to create a sense of urgency.

How Much Does it Cost to Start a Business?

Here’s the question all small business owners want answered—how much money does it cost to start a business? Sorry, there’s no one answer to the amount of capital you’ll need to start a business—but you can get close by creating The Big List of your expenses.

Start by listing all your expenses—from office space to office supplies. This expense breakdown should include the cost of insurance, equipment, licenses, and permits (if required). You’ll also need to include your marketing and advertising costs, communications systems, how much in employee salaries, and don’t forget about attorney and accountant fees.

Once you’ve gathered a list of your business expenses, add it all up for the big picture. This is the number you can take to the bank when you are looking for funding.

With a plethora of lending options and historically low interest rates, now’s a terrific time to start your small business. Now that you have a realistic set of objectives—and a clear understanding of your business goals—you’ll be able to seek which type of small business loans and lenders are right for yours.

Need Help With Business Funding?

Funding Circle and Fora Financial are online lenders that offer a variety of options. Online lenders are often able to fund business loans quicker than traditional lenders can, which makes them attractive options for businesses that need capital fast.

How Else Can Skip Help?

Whether you need help navigating small business funding–like SBA loans, grants, or other financing options–or help with other government-related services–like TSA PreCheck or DMV appointments—Skip is here.

Skip the Red Tape with Skip.

👉🏻 Get early access to Grants & Funding Opportunities

👉🏻 Compare Online Business Insurance Rates

👉🏻 Apply for an SBA Loan

👉🏻 Get Started with Skip