How to Spot PPP Scammers

Millions of small business owners are applying for Paycheck Protection Program (PPP) funding for their small businesses. Unfortunately, there are criminals attempting to take advantage of vulnerable business owners through scams, by pretending to be lenders or even the Small Business Administration (SBA). Here are some examples of common PPP scams, and how to protect yourself.

Scam #1: Fake Government Officials

Some scammers are actually pretending to be government administrators from the SBA. They may call and tell you you are eligible for a loan of up to $250,000, or tell you you’ve already been approved for a loan and ask for personal information to disperse it. Once you give them your information, these scammers can use it to steal money from your business.

So how can you tell what’s fake? The SBA won’t call you to ask for your personal information or to demand funds. If you get a call from an unknown number that claims to be the SBA and an official demands that you send money or provide personal information, it’s probably a scam.

PPP scammers try to contact people by email as well. They will try to copy the SBA logo and make the email look official (check out the example below), but the SBA won’t contact you asking you to sign forms to get your PPP loan, since you apply through a lender. You will likely hear from your lender directly regarding anything you need to do to receive your funds.

Source: First Interstate Bank PPP Scam memo

A side note is that there are legitimate third-party companies that are helping people (like us at Skip), but they'll nearly always identify themselves as a third-party not affiliated with any government entities, as well as be transparent about what they can and cannot help you with.

Scam #2: Fake Lenders

Scammers will pretend to be PPP lenders as well. Usually, these scammers tell business owners that they are approved for a loan, and then ask for personal information so that they can send it to you (then they use the information to take money from you or use your credit card or bank account). If you get a phone call or email from a lender you haven’t heard of saying you are “pre-approved” or “automatically eligible” for a loan, or even asking for payment in exchange for a loan, don’t respond or click the email. These are all common scam tactics for PPP scammers.

Real lenders never approve businesses before they have applied, and they won’t ask for payment from you to disburse your loan. Make sure that you apply for the PPP with a trusted, vetted lender. We have several partners we trust that you can apply with right through our app, including Bluevine and Credibly and they'll let you know whether you're eligible for funding or not.

Scam #3: Fake Loan Applications

Scammers have even gone as far as to apply for PPP loans in the name of small businesses. The owner of Vinings School of Art, a small art school for children in Georgia, got a call from the SBA asking her to verify information on her loan application for her second PPP loan, but she had never applied. A scammer had applied in her name for a $71,000 loan. Thankfully, the SBA closed the application and the loan wasn’t sent, but scammers are working around the clock to evade the SBA.

To make sure no one applies for a loan in your name, keep a close eye on your credit report, your business’ bank account and all correspondence for your business. If you suspect that someone may have applied in your name, contact the SBA immediately so that they can close the application.

Scam #4: Social Media Scammers

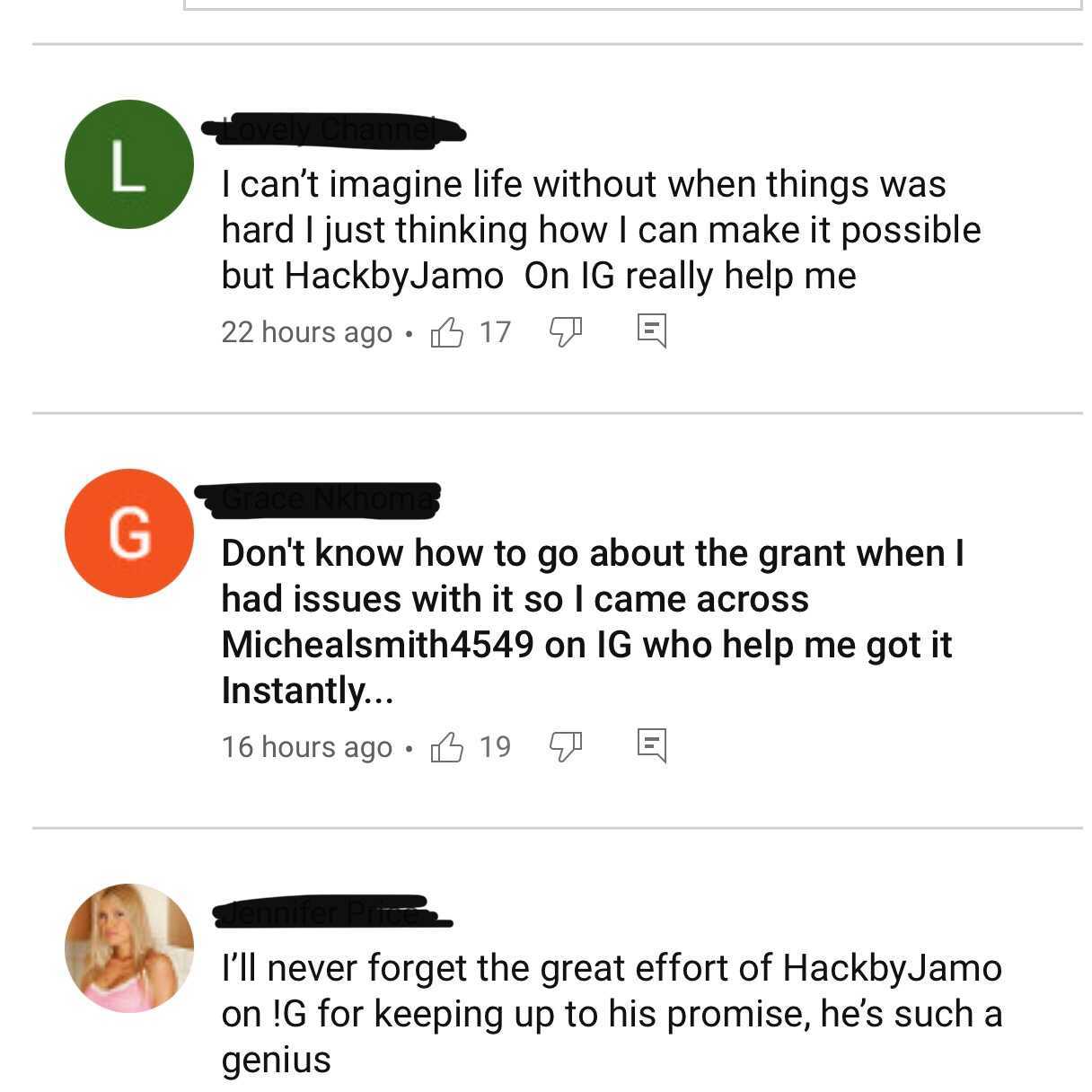

If you follow content creators like us on social media and YouTube, you might notice that there are hundreds of comments on posts about the PPP, EIDL and other government programs (see examples below) from people claiming that various unvetted accounts offered them grants or loans.

These accounts are usually fake, and they are trying to steal information or money from people who are watching or reading content to learn about government programs and stimulus funding that they need.

Ignore these comments and don't reach out to their recommended lenders. Stick with real, vetted lenders and official application processes to get help.

The best way to protect yourself from fraud is to apply for the PPP with a trusted lender and get your information on stimulus funding programs from legitimate sources. You can follow our blog and app to get the latest info on the PPP and other funding programs from our team, and if you haven’t applied yet, it’s not too late to get your application in with one of our partners. You can also get exclusive information on funding programs and services with a free trial of Skip Plus.