How To Save Money Before The End Of The Year

It's tax deduction season time! Time to consider making business or personal expenses that can help reduce your 2022 tax bill. Here is why you should consider taking action, an example of how to save $1,000* when you purchase a Skip membership, and 5 year-end tax tips.**Not tax advice

Maximizing Your 2022 Year End Tax Deductions

If you want to reduce your taxable income, you'll need to take steps to do this before the end of the year. We've listed 5 year-end tax tips below, but we're starting with the #1 option.

One of the best things you can do if you're looking to fund and grow your business in 2023 is purchase a Skip membership. A 1-1 Skip membership can be an essential part of your business in 2023 — helping you find out about business resources, apply for funding, and most importantly, save you time.

Check out the various membership options or book a call with us to discuss. Alternatively, call us at 650-695-6133.

$1,000 Year End Tax Savings Example

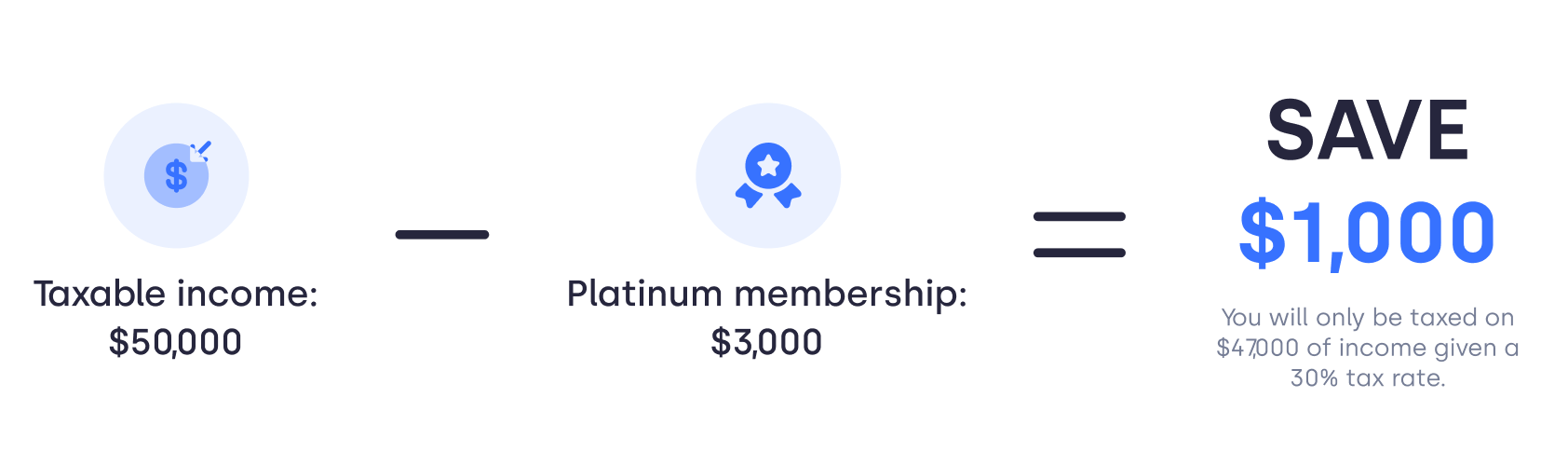

Let's say your taxable income in 2022 is $50,000 at the moment. If you purchased our Skip Platinum Annual membership, you'd reduce your taxable income by $3,000.

If your taxable income rate is 30%, that means you could save $1,000 in owed taxes*. Another way of looking at is getting $1,000 off the Platinum annual membership. *Not tax advice, check with your accountant!

Want to learn more and how we can be an essential part of your business in 2023? Check out membership options or book a call with us to discuss before time runs out! Alternatively, call us at 650-695-6133.

5 Tax Deduction Tips for Small Business Owners

- Stock up and pre-pay expenses: Do you need supplies or inventory for your business? If you have extra cash sitting around, consider pre-paying these expenses to reduce your tax burden.

- Switch to annual plans for any subscriptions: If you have any subscription services, like a Skip membership, consider switching to an annual option instead of monthly or quarterly.

- Write off bad business debt: Bad debts can be written off before the end of the year and then deducted from your taxable income. Run your accounts receivable aging report to see which receivables are unpaid from customers.

- Write off or write down equipment and inventory: Review your business inventory and equipment. Obsolete, damaged, or worthless equipment can be written off.

- Give employees bonuses or gifts: In addition to receiving a potential tax deduction for paying bonuses or gifts to employees, you may also receive goodwill from them, especially around the holidays.