How to Open a Free Online Business Checking Account With No Deposit

Did you know you can open a business checking account with no money? If you’re new to business and haven’t started generating cash flow, this may come as a welcome surprise. While the majority of banks require a cash deposit to open an account, we found two that don't.

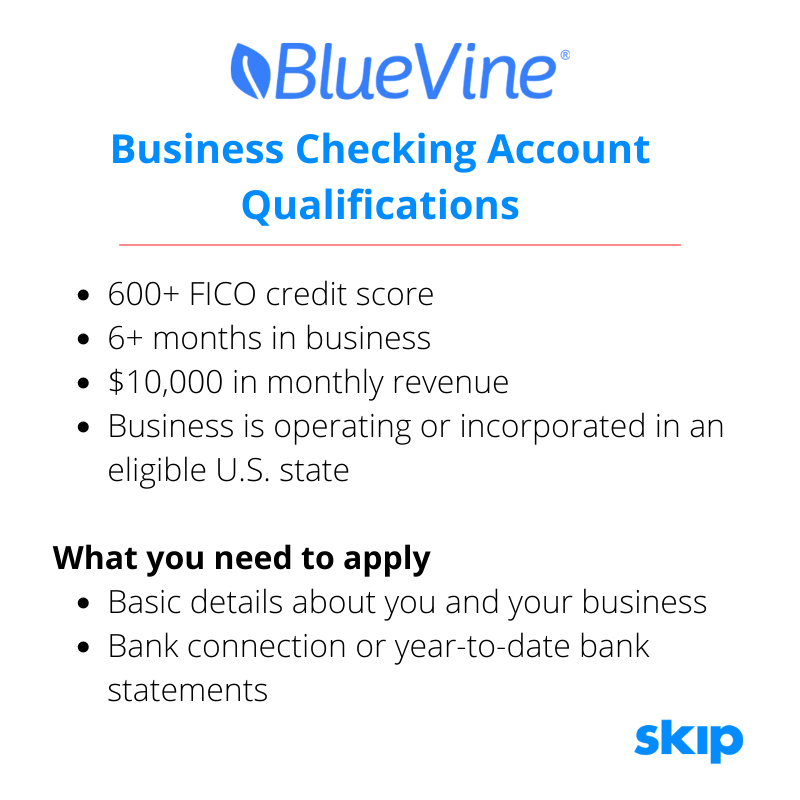

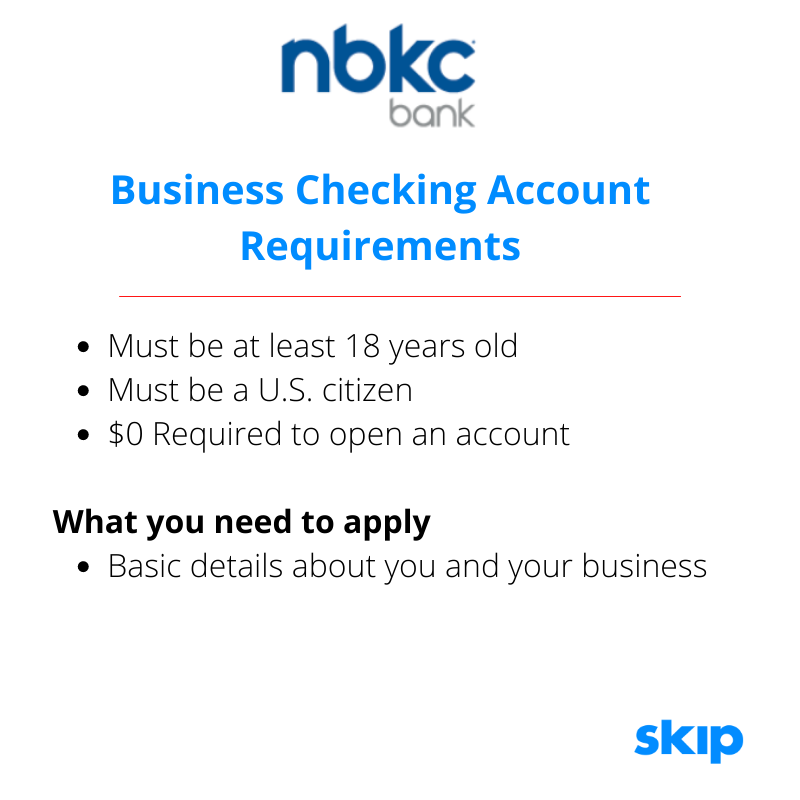

In this article, we review BlueVine and NBKC, two online banks that allow you to open a business checking account — without a deposit — in a matter of minutes. We also show you how to open an account with each bank. Here's how to open a business checking account online without a deposit.

BlueVine — Free Online Business Checking Accounts

Open a BlueVine business checking account with no minimum deposit or balance, and once you start depositing cash you’ll earn 0.6% interest on account balances over $1K. Your Blue Vine business checking account also provides:

- Free cash deposits at over 90K GreenDot locations

- Fee-less ATM access to 40K MoneyPass locations

- Mobile and online banking options

- Two free checkbooks

- Unlimited transactions

- Vendor payments via ACH, wire, or check

How to Open a BlueVine Business Checking Account

First, download the BlueVine app or apply online. Each interface will vary depending on your browser or device.

Step 1 — Create an Account. To open a business checking out with BlueVine, you’ll first need to create an account. Complete the preliminary questions, then click on the “Get Started” button or connect with your Quickbooks account.

Step 2 — Complete Business Information. Once authenticated you’ll proceed to the next screen asking for information about your business, including entity type, your ownership percentage, social security and EIN numbers, and a physical mailing address (cannot be a PO Box).

Depending on your entity type, you may need to upload additional documentation to further validate your business.

- Corporations. Articles of Incorporation filed with the state.

- LLC. Articles of Organization filed with the state.

- Partnerships. Business license and partnership agreement.

- Sole Proprietorship. Use your SSN and provide proof that your business has a registered name and valid business license.

Step 3 — Agree to Terms and Conditions. Now that you have completed your business information and uploaded any necessary documents, you’ll be asked to review the terms and conditions before submitting, and ensure your application is correct and complete.

Since online banks are far more agile than their brick and mortar counterparts, you should receive approval in a matter of days, and can immediately begin using the account. We suggest funding your business checking account as soon as possible to begin earning interest; however, it’s not a requirement.

NBKC — Free Online Business Checking Account

NBKC is another online bank with free business checking options. Unlike BlueVine, this is not an interest-earning account; however, aside from the no deposit, no minimum balance, and no transaction fees, NBKC provides some other advantageous perks — especially useful for businesses just starting out — with a nearly fee-free banking experience. Here's what an NBKC account includes:

- Bill-pay services

- Cashier checks

- Fee-less ATM access to 32K MoneyPass locations

- Incoming domestic wire transfers

- Mobile and online banking

- Non-NBKC ATM service charges refunded up to $12 per month

- Overdraft protection

- Unlimited transactions

- And more

With NBKC, the only time you'll be charged a fee is when you send a domestic wire transfer ($5), or receive international wire transfers ($45). NBKC also offers an online Business Money Market Account. Fund it with as little as $.01 to begin earning interest. Consider opening both accounts at the same time.

How to Open an NBKC Business Checking Account

Step 1 — Create an Account. To open a business checking out with NBKC, you’ll first need to create an account. Complete the preliminary questions, then click submit. You’ll receive an authentication email momentarily. Click through to the site and create your login credentials.

Step 2 — Complete Personal & Business Information. Once authenticated, you’ll proceed to the next screen asking for information about your business, such as entity type, ownership percentage, social security and EIN numbers, and a physical mailing address (cannot be a PO Box).

Depending on your business entity type, you may need to upload additional documentation to further validate your business.

- Corporations: Articles of Incorporation filed with the state.

- LLC: Articles of Organization filed with the state.

- Partnerships: Business license and partnership agreement

- Sole Proprietorship: Use your SSN, and provide proof that your business has a registered name and valid business license.

Step 3 — Agree to Terms and Conditions. Review the terms and conditions before submitting your application to ensure it's correct and complete. Expect approval within five to seven business days. Once approved, you’ll receive an email with your new business checking account information, followed by the arrival of a business debit card via USPS mail.

Download the app and begin using your account on your mobile device, or access your account via the desktop. Each interface varies slightly.

Within the first 30 days of opening your free NBKC business checking account, all deposits will be held for up to nine business days as an extra layer of security and to prevent fraudulent transactions.

Get Help With Your Business

Do you need help with your business budget or getting funding for your business? We can help you with SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.