How to Complete SBA Form 1919 in 7 Steps

If you’re a small business seeking funding through the Small Business Administration’s (SBA) 7(a) loan program, the SBA wants to know more about you, your business, and its owners before guaranteeing your loan with a bank or lending institution.

In this article, we’ll describe what SBA Form 1919 – Borrower Information Form is, how it’s used, who needs to file, and provide step-by-step instructions on how to accurately complete Form 1919 to help position you for fast approval.

In This Article:

- What is SBA Form 1919

- Who needs to complete Form 1919

- Step 1: Section I - Identifying Business Information

- Step 2: Section I - Questions 1 - 11

- Step 3: Section I - Questions 12 - 16

- Step 4: Section I - Review, Sign, and Date

- Step 5: Section II - Principal Personal Information

- Step 6: Section II – Principal Personal Information Questions 17 - 26

- Step 7: Section II - Review, Date, and Sign

What is SBA Form 1919?

SBA Form 1919 is used to collect business-related and personal information about your small business and its owners, and is divided into two sections:

- Section 1: Business Information — information about the business

- Section 2: Personal Information — information about the principals’ personal history

Form 1919 is used to gather loan request information if your business has ever received current or past government financing, what your existing debts are, and other relevant business and personal information to determine your loan eligibility. Lastly, Form 1919 facilitates background checks to prevent fraud.

Who Needs to Complete Form 1919?

Any business requesting a government-backed loan through the SBA – such as the 7(a) loan – is required to complete Form 1919. Additionally, if your business consists of more than one person, each principal (owner) is required to provide their personal financial information as part of the process. We’ll cover this more in Section II – Personal Information.

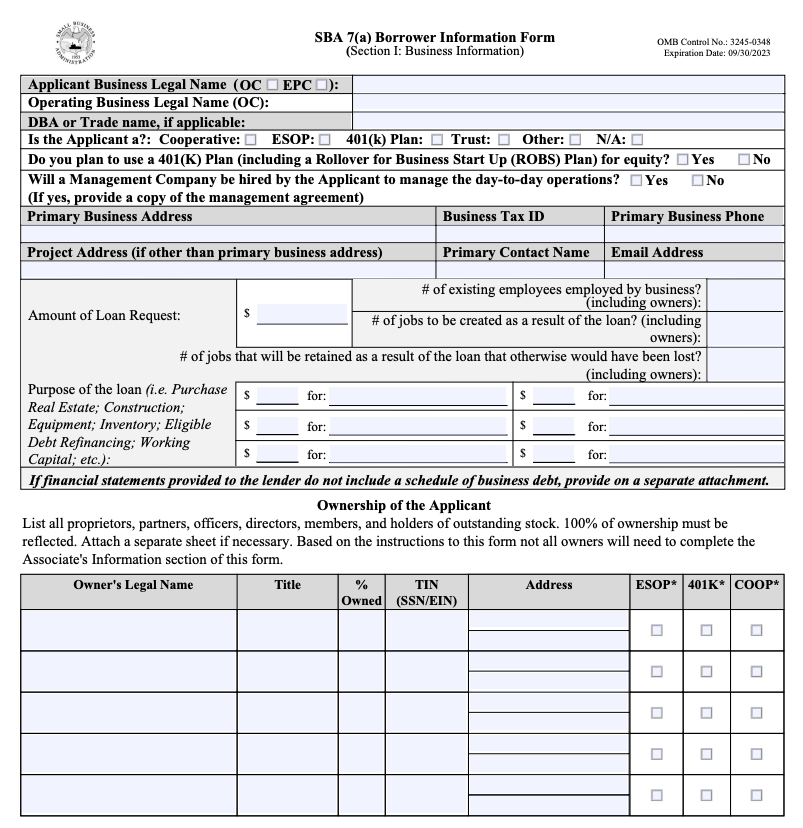

Step 1: Section I - Identifying Business Information

You’ll begin the application process by completing the Business Information section. You’ll need the following information to complete this section:

- Your Business Name as it appears on your tax returns

- Business address

- Applicant Business Tax ID, or Employee Identification Number (EIN)

- Your Doing Business As (DBA) or Trademark name if your business operates on something other than its legal name.

- Is your business an operating company (OC), or an eligible passive company (EPC)?

Operating Company or Eligible Passive Company. The SBA defines an Operating Company, or OC, as an active small business located on real property owned by an Eligible Passive Company, or EPC.

An EPC is a business entity not engaged in a regular or continuous business activity but leases real or personal property to an OC for use in the Operating Company's business.

You’ll also be required to provide the following information about your business’s operations:

- Loan amount requested

- Brief summary of the purpose of the loan

- Number of existing employees, including owners

- Number of jobs to be created using the 7(a) loan (including owners)

- Number of jobs retained as a result of the loan

- Step 4: Section I - Review, Sign, and Date

- Step 5: Section II - Principal Personal Information

- Step 6: Section II – Principal Personal Information Questions 17 - 26

Use your best estimate if you’re unsure of how many jobs will be created (or lost). It’s also unnecessary to include contract workers or freelance employees in your headcount.

The final section of the Applicant Business Information asks for a list of all owners, officers, directors, their titles, and the percentage of their stake in the business. You’ll also need to include the names of holders of outstanding stock. Attach an additional sheet to complete this section if necessary.

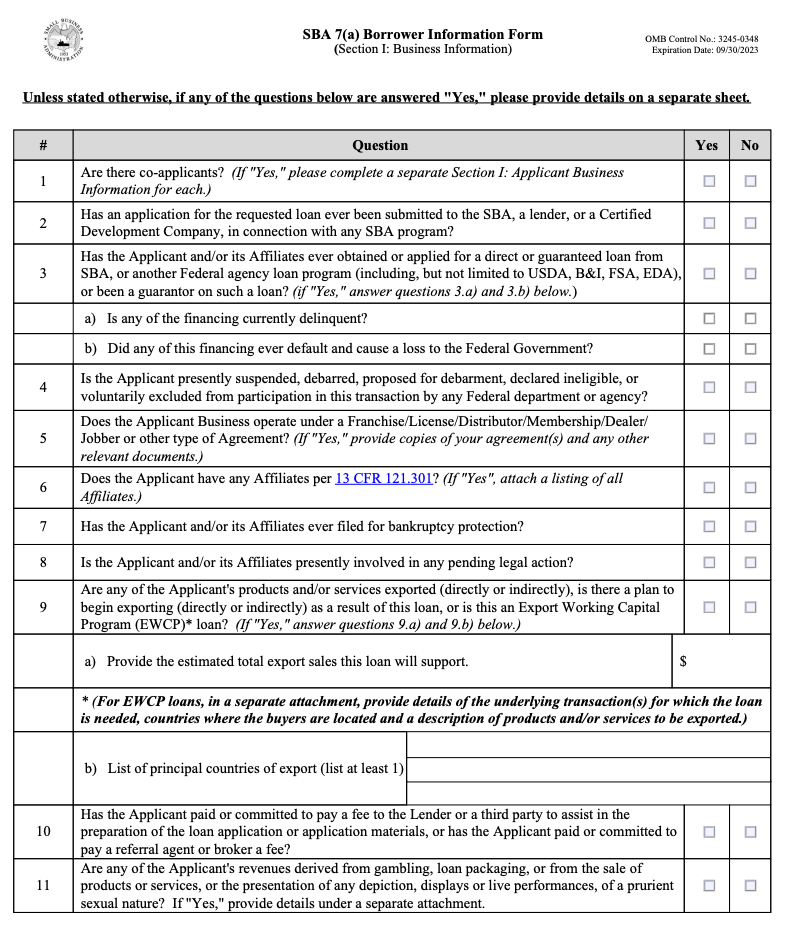

Step 2: Section I - Questions 1 - 11

This is a “Yes” or “No” list of questions, where several require supporting documentation if answered in the affirmative. For example, question 2 asks the following: Has the business previously applied for an SBA loan? If “Yes,” you'll need to provide the details of your previous loan request along with Form 1919.

The following is a comprehensive list of questions you’ll need to answer along with an explanation of the request, and the supporting documentation needed for an affirmative response.

- Are there co-applicants?

Co-applicants include other businesses applying for an SBA loan along with this applying business. Each co-applicant needs to complete their own SBA Form 1919, Section I. - Has the business previously applied for an SBA loan?

If “Yes,” provide the details of your loan request, date of application, the amount requested and purpose of loan, which loan program, and whether your application was accepted or denied. - Has a federal department or agency deemed the business ineligible for an SBA loan due to regulatory action?

If “Yes,” your SBA loan application might be denied. - Does the business operate under any type of agreement?

If you operate under a distributor, license, franchise, membership, jobber, or dealer agreement, attach a copy of the agreement along with other documents for the SBA to better understand the nature of your agreement. - Does the business have any affiliates?

The SBA defines affiliate businesses as “one business controls, or has the power to control another; or when a third party (or parties) controls or has the power to control both businesses.” If your business has affiliates, include their names on a separate sheet. - Have any applicants or affiliates ever filed for bankruptcy?

If "Yes," attach details about the bankruptcy. - Is the business or any of its affiliates currently involved in pending legal action?

Provide details about any ongoing legal action on a separate sheet. - Has the business or its affiliates ever obtained or been a guarantor for a federally-backed loan?

If “Yes,” note whether any federally-backed loans are currently delinquent or in default. Provide details including the amount and purpose of the loan. - Are any of the business’s products or services exported?

If you export your products or services abroad, or if you plan to do so with the proceeds of the loan, check “Yes.” Provide an estimate of the value of export sales facilitated by the loan. - Is the business using a third party to help with their SBA application?

Check “Yes” if you hired a broker, lawyer, packager, accountant, or other professional to prepare your SBA loan application. Also, check “Yes” if you were referred to a lender by an agent.

On a separate form, include the name of the entity/agency along with their fees. Complete SBA Form 159 for every agent receiving compensation for their role in your loan application. - Does the business earn revenue through vice activities?

The SBA does not fund businesses involved in vice industries (or other ineligible industries), including loan packaging, gambling, and pornography.

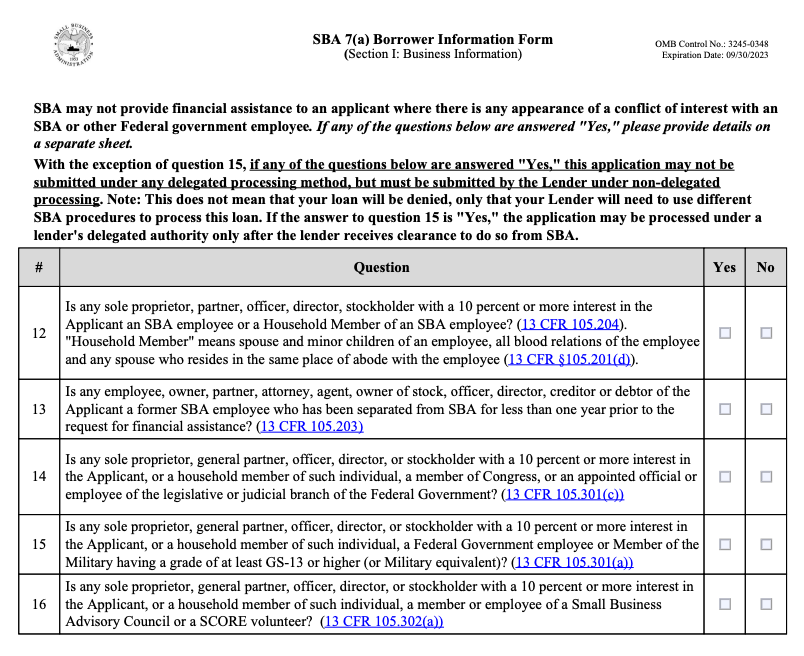

Step 3: Section I - Questions 12 - 16

To complete Section 1, you’ll need to answer a set of five “True” or “False” questions to determine if there are any conflicts of interest between the Applicant, the SBA, its employees, or some elected officials. For example, a conflict of interest could be any of the following:

- The applicant is an SBA employee or a household member of the SBA employee.

- Former SBA employees who left the agency less than 12 months before applying.

- An applicant is a member of the U.S. Congress, an appointed government official in the legislative or judicial branches, or their household members.

Any “False” responses do not necessarily preclude you from garnering approval for your loan, but they may take longer to process. These applications are reviewed directly by the SBA using an alternative set of procedures, rather than the usual protocols of an intermediary lender.

Be prepared to disclose additional information about the relationship between your business and the government employee.

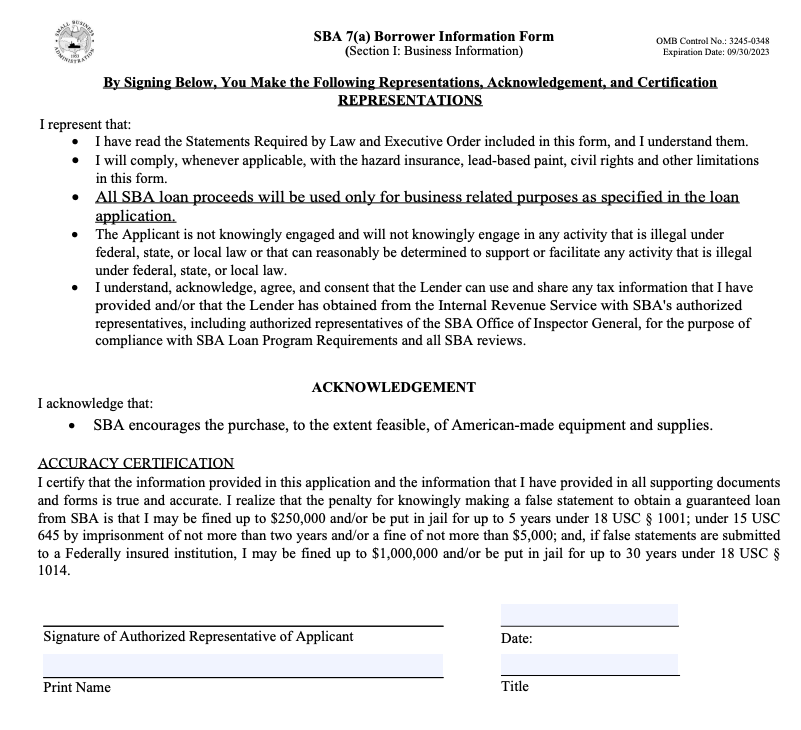

Step 4: Section I - Review, Sign, and Date

Here’s where you should take the time to review your information for accuracy and gather any supporting documents as indicated by a “Yes,” or “False” response in the previous sections.

Step 5: Section II - Principal Personal Information

Section II of SBA Form 1919 gathers personal information about the business’s owners and its principals, defined as the following:

- Anyone with 20% or more ownership in the business

- Anyone hired to manage day-to-day operations

- Business owner(s)

- Directors

- Managing members

- Officers

- Partners

- Trustors

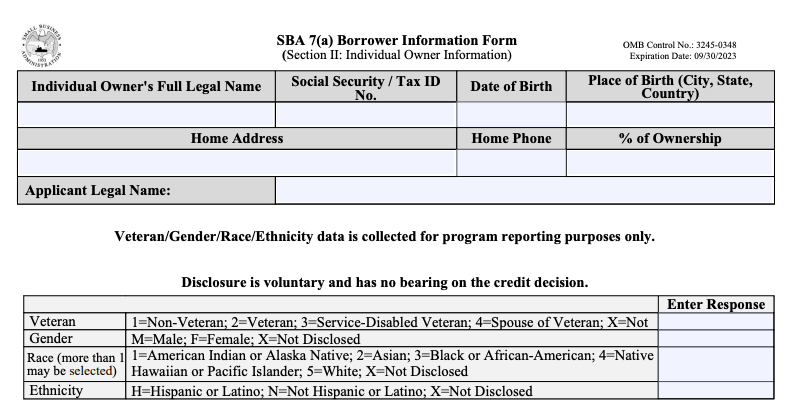

Remember — all these entities must complete and file their own version of Section II’s information when submitting Form 1919. Complete this portion of the form with your personal information, e.g. your SSN – not EIN – etc. Include date and place of birth, home address, phone number, along with the % of ownership in the business.

The second portion of this section is voluntary. However, you may choose to self-select your veteran status, gender identity, racial identity, or ethnic background. This information is gathered strictly for reporting purposes and does not impact the outcome of your loan application.

Step 6: Section II – Principal Personal Information Questions 17 - 26

The next set of “Yes” and “No” questions are specific to each of the aforementioned owner(s) and are used to assess the individual applicants’ financial health.

As in Section I, if any of the ten questions in Section II are answered in the affirmative, you’ll need to provide supporting documentation.

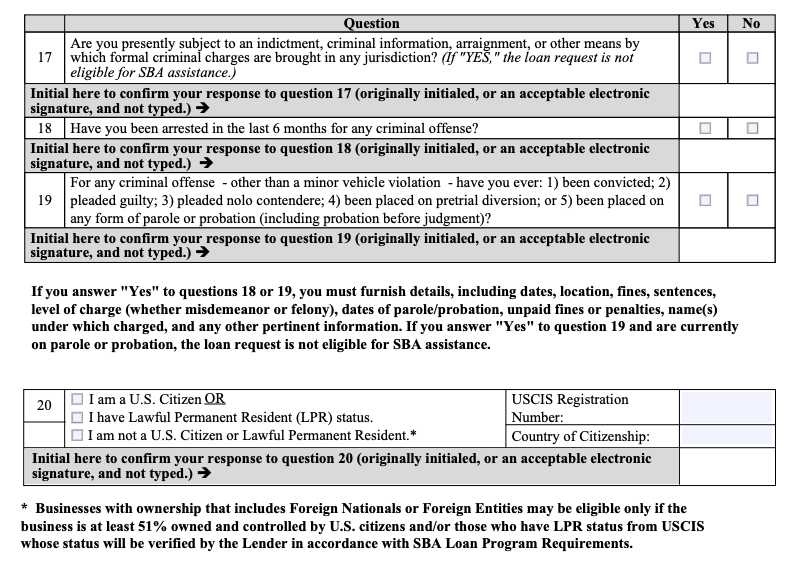

17. Are you currently facing criminal charges?

Unfortunately, answering “Yes” is a guaranteed denial from the SBA. Agency standards preclude anyone currently incarcerated, on probation or parole, indicted for a felony or serious past crimes, or anyone with a deferred prosecution is ineligible for any SBA loan program.

18. & 19. Have you been arrested in the past six months for any criminal offense?

Answering “Yes” does not preclude you from approval; however, you’ll need to include SBA Form 912, Statement of Personal History. Here, you can provide details about any convictions so the SBA can make further assessments about your loan eligibility.

Tip: Remember questions 17 - 19 require your initials on the response as well as a “Yes” or “No” response.

20. Has your business violated federal regulations?

If “yes,” you’ll need to provide details about these violations. You might be ineligible for an SBA loan.

21. Are you more than 60 days late on child support payments?

Answer “Yes” to this question only if you own 50% or more of the business.

22. What is your U.S. citizenship status?

Affirm your U.S. citizenship or lawful permanent residency (and your registration number) if they apply. If neither, list your country of citizenship — non-U.S. citizens can apply for SBA loans as long as they have a green card.

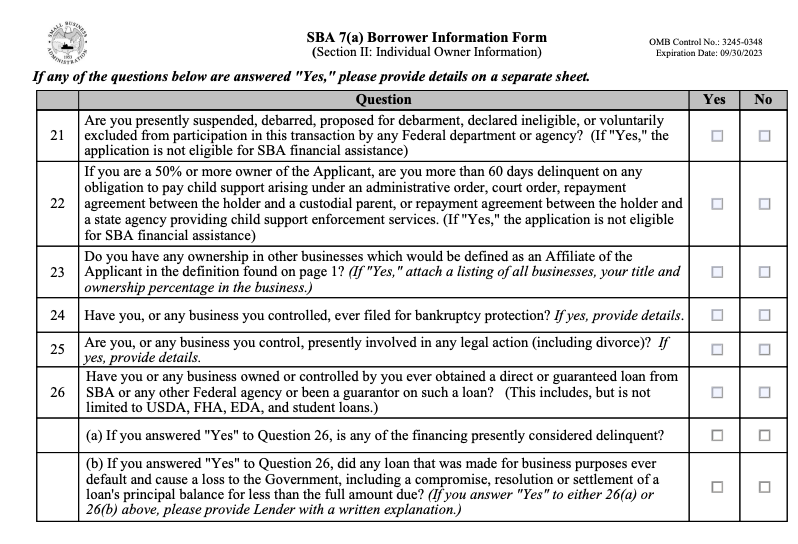

23. Do you own a stake in an affiliate business?

If “Yes,” include the name of the affiliate business and percentage ownership on an attached sheet.

24. Have you or any business you controlled filed for bankruptcy?

A “Yes” means you’ll need to include details of the bankruptcy; however, you are still eligible for an SBA loan as long as the bankruptcy has been discharged.

25. Are you currently involved in legal action, including divorce?

Include details of pending civil cases filed against you or your business.

26. Have you or a business you’ve controlled ever obtained federal funding, or been a guarantor on a federal loan?

Check “Yes” if you or a business you’ve owned in the past received an SBA or other federal government loan. These include federal student loans and FHA loans. Indicate if the loan is currently delinquent, or in default.

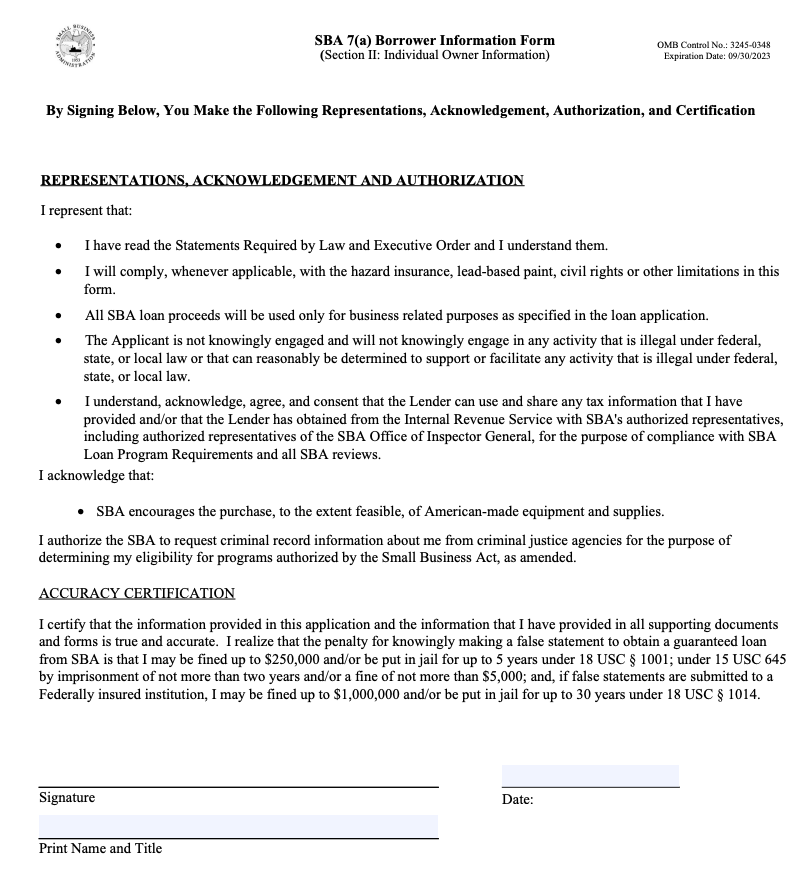

Step 7: Section II - Review, Date, and Sign

You reached the end of Form 1919’s application. You’ll be asked to sign and date the secondary portion of the application as well. Be sure to review your answers for veracity and completeness.

You may also want an attorney to review your application for any outstanding issues. Here's how to finish the process:

- Sign and date the application.

- Download a hard copy if you filled out an online application.

- Compile your complete set of documents as outlined in Section I and II to take to your SBA lending partner.

Need Help Filling Out Your SBA 1919 Application?

Putting together all the necessary documents can be overwhelming. Let Skip’s specialists guide you through the process with individualized support.

We can help you with SAM registration, SBA loans, grants, or other business financing options. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.