How to Change Your Business Name: A Complete Guide

The name of your business is important because it defines your company and sets you apart from your competition. There may come a time, for a variety of reasons, that you want to change your business name.

In this article we list some reasons why you may decide to change you name, offer guidance on what to do before changing your name, and articulate the process of changing your business name no matter your business structure.

Reasons to Change the Name of Your Business

There are several reasons why you may decide to change the name of your business. Here are some of them:

- Your business function or model has drastically changed and you want a new name to reflect that change.

- You bought a business that has someone else's name in it (Gary's Diner, for example).

- You found out that your business name is trademarked by someone else and yours must adopt a new name.

- You simply don't like the name anymore or it doesn't resonate with your customers.

Before Changing Your Business Name, Do Some Research

Before you go through the process of modifying your business name, you need to conduct some research–especially if you have an LLC or corporation. Your name needs to be unique; otherwise, other business owners can sue for trademark violation.

Check with your Secretary of State's office first to see if the name you want is available. Then, search through the U.S. Patent and Trademark Office to see if the name you want to use is trademarked. Once you have verified the name you want to adopt is available, you're clear to go.

It's not a bad idea to speak with an attorney who is familiar with trademarks and business law to assist you in this process.

How to Change the Name of Your Business

Depending on your business structure, the process may differ. Sole proprietorships and partnerships will be easier to change than an LLC or a corporation. The following instructions step you through changing your name based on your business structure.

Sole Proprietorship and Partnership

If you're a sole proprietor or have a partnership, it means you have not established an entity or official business structure with your state. You and your business are considered the same entity–there's no separation. By default you conduct business under your legal name, but here's how to change that.

- File for a fictitious name. A fictitious name (also called trade name or 'Doing Business As' /DBA) is essentially a nickname. You can file for a fictitious name through your state's Secretary of State office.

- Check with local authorities. Once you file for a fictitious name, check with your city and county business offices to verify if you need new business licenses and permits in the name of your DBA.

- Contact your bank. After you check with your local businesses offices, contact your bank to see if you need to change the name of your business account or open a new one,

- Notify the IRS. Lastly, let the IRS know that you are operating under a fictitious name. The notification needs to be signed by you, the owner, and sent to the IRS where you send your tax information.

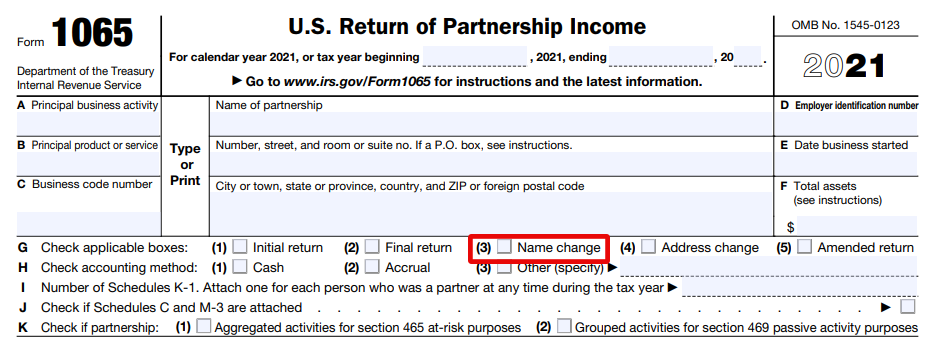

For partnerships, you can notify the IRS of your name change when you file form 1065, on line G box 3. If you already filed taxes for this year, simply write to the IRS at the address where you file your taxes.

Limited Liability Companies and Corporations

The process for changing the name of your LLC or corporation is similar to a sole proprietorship and partnership, with some slight changes. There are essentially two ways to do it, file Articles of Amendment or file for a fictitious name.

- File Articles of Amendment with your state. Filing these articles means that you are asking the state to recognize your business by the new name. Once approved, you're good to operate under that new name. If your business operates in multiple states, you will need to file an amendment in each state.

- File for a fictitious name. Just like a sole proprietor, this is how to change your LLC's name or corporation's without going through the amendment hassle. File for a fictitious name in the states(s) that you operate in and you're good to go.

- Don't forget about local authorities and your bank. Once you have a new name, contact your city, county, and bank so all official documents and accounts reflect your name change.

- Let the IRS know. If you have a single-member LLC, follow the directions for sole proprietors. If you have a multi-member LLC, follow the directions for partnerships.

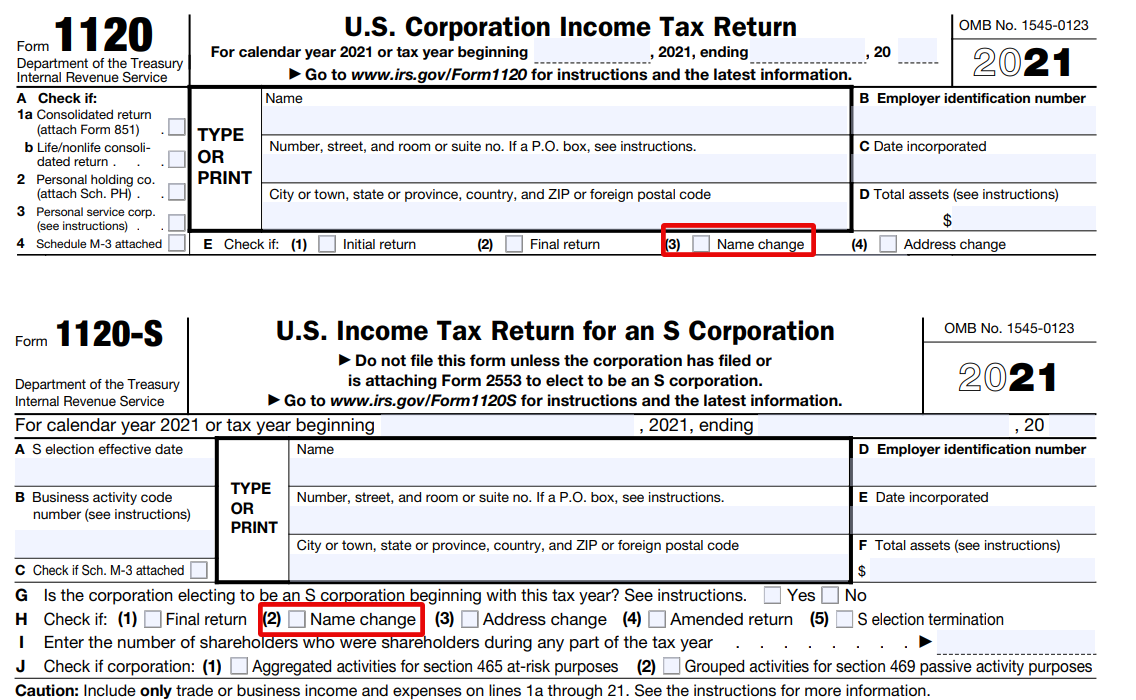

For corporations, you can notify the IRS of your name change when you file your taxes. For Form 1120, mark box 3 on page 1, line E.

For Form 1120-S, mark box 2 on page 1, line H. If you already filed your return for the current year, simply write to the IRS at the address where you file your taxes, signed by a corporate officer.

Remember to Update These as Well

After you change the name of your business with the appropriate state filings and federal notification, numerous other items need to reflect your name change as well. Don't forget to update:

- Your website

- Stationary and business cards

- Signage

- Marketing and advertising materials

- Brochures or menus

- E-mail footer

- Other businesses that link to your site

- Anything else with the old name

Get Help With a Name Change or Business Funding

Do you need help changing the name of your business or have business funding questions? We can help with EIDL applications, SBA loans, or other business financing questions. Get ongoing personalized help from our team. Join Skip Premium today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need help navigating small business funding–like SBA loans, grants, or other financing options–or help with other government-related services–like TSA PreCheck or DMV appointments—Skip the red tape.