How Small Businesses Fared in 2022 (Part One)

As the backbone of the US economy, small businesses have a major impact on the country's overall economic performance. While some businesses struggled to regain their footing post-pandemic, others made strides this year in recovering and even growing to new heights.

We surveyed nearly a thousand small businesses owners to learn how they fared this year with respect to growth and funding. Here's what we learned:

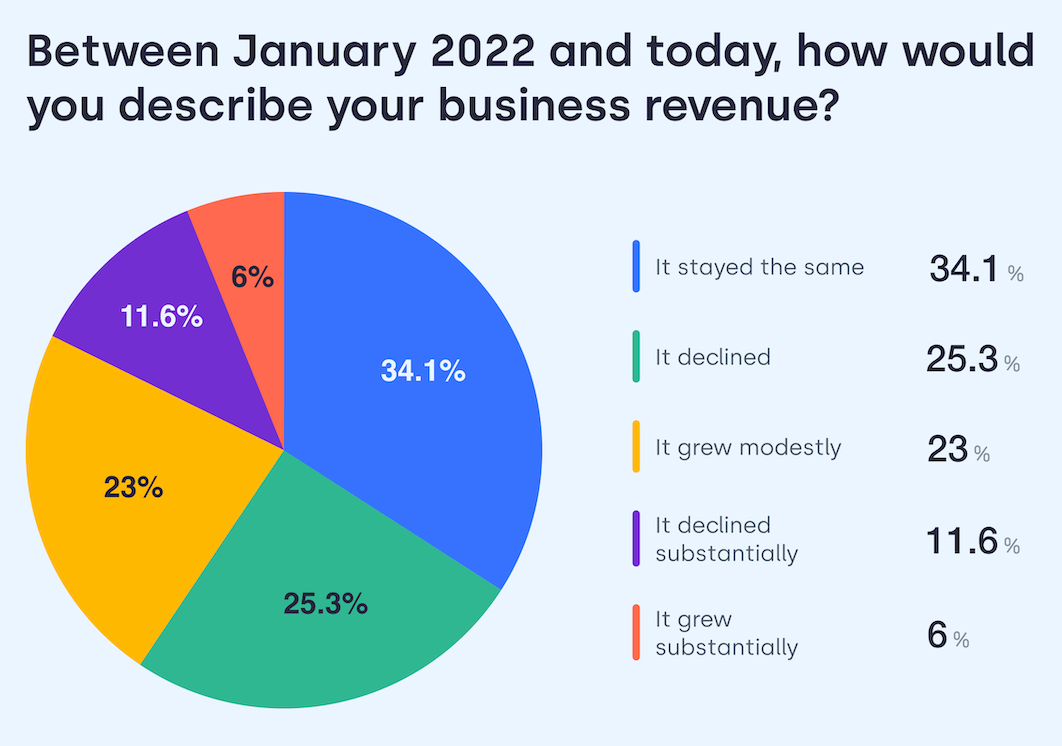

Businesses experienced modest growth

One third of business owners surveyed (34.1%) said their revenue stayed about the same over the course of 2022. These businesses largely did not experience a significant increase or decrease in their volume of business.

A slight plurality of respondents (36.9%) indicated their business revenue in fact declined throughout 2022. 25.3% experienced a decline and 11.6% experienced a substantial decline. Many of these businesses were impacted by economic factors such as inflation, rising interest rates, or supply chain difficulties.

That said, 2022 was a good year for many small businesses. 29% experienced revenue growth – 23% reported modest growth, and 6% said their business's revenue grew substantially. These companies were able to make significant strides despite a host of challenges to economic growth in 2022.

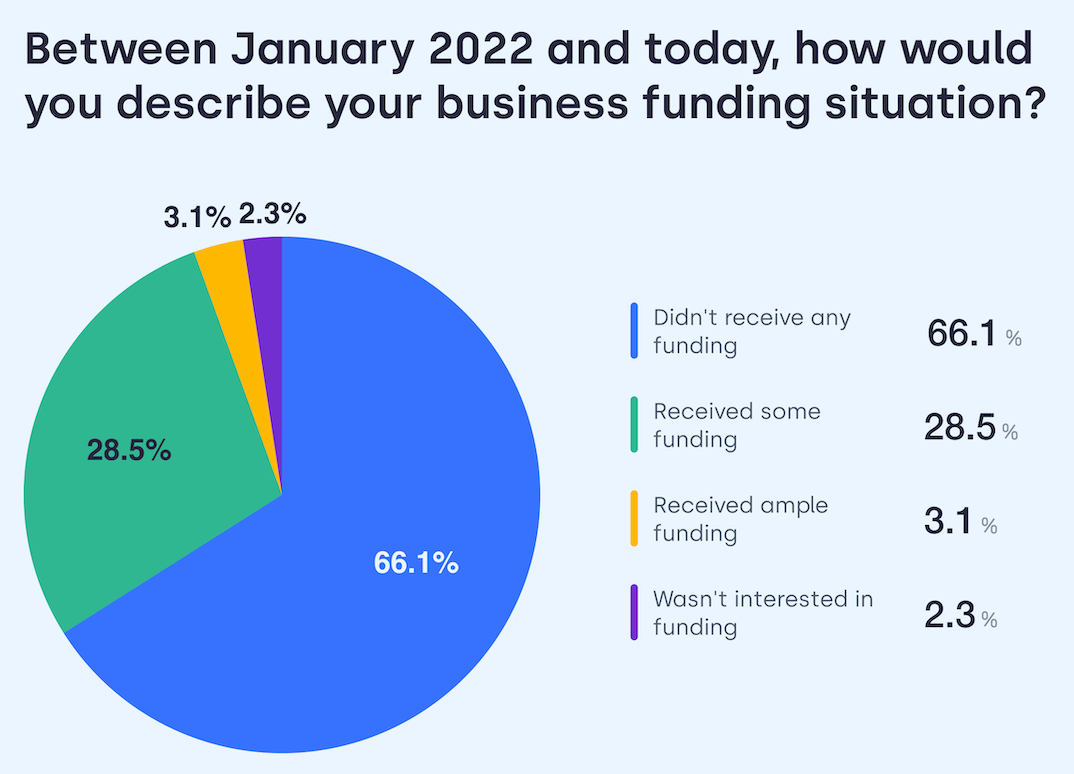

Two thirds of businesses did not receive funding

2022 marked the end of the popular EIDL program, which provided government-subsidized grants and low-interest loans to small businesses to assist in recovery from the pandemic. As EIDL ended and the funding landscape transitioned back to pre-pandemic norms, many businesses were not able to secure additional funding in 2022.

Two-thirds (66.1%) of survey respondents did not receive any funding in 2022. A range of factors made securing funding especially challenging in 2022, most importantly the end of pandemic recovery programs as well as economic challenges like inflation and continued supply chain issues.

Yet, many small business owners were able to overcome these challenges and secure funding in 2022. 28.5% of business owners surveyed reported that they received some funding for their businesses, and 3.1% reported receiving ample funding. These businesses received EIDL Loan increases, SBA loans, and took advantage of private funding options.

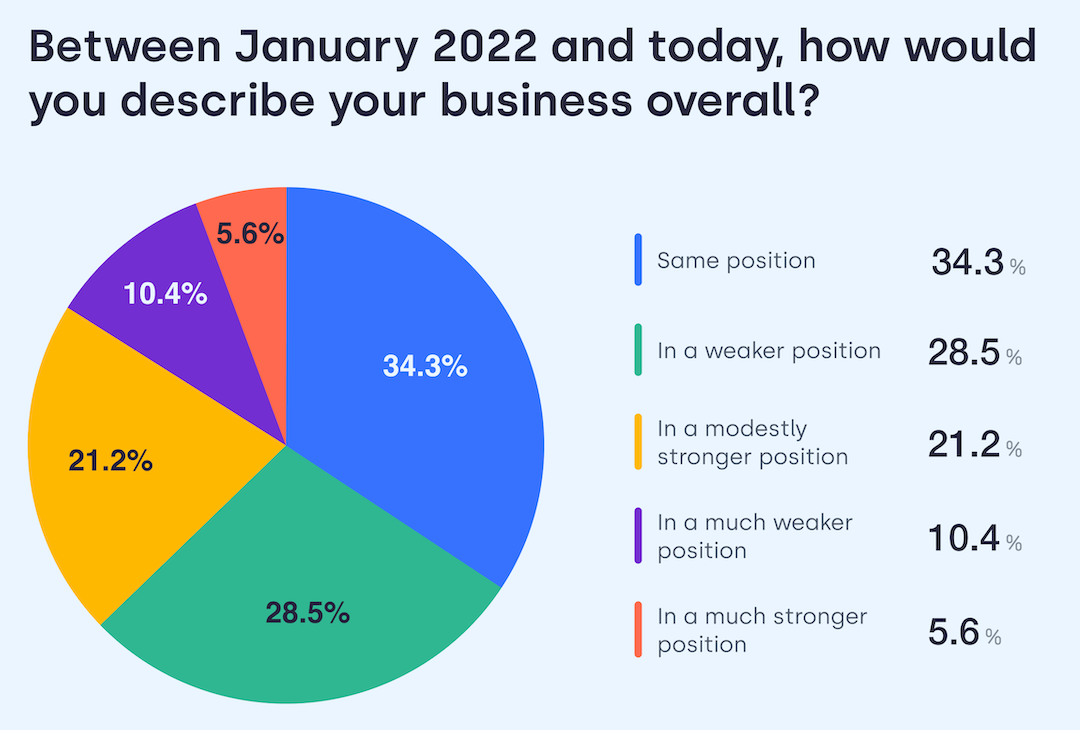

2022 was a challenging year for many business owners

Overall, small businesses struggled to get funding and grow in 2022. A litany of economic challenges combined to limit growth, leaving a slight majority of business owners feeling frustrated with their business's performance this year.

One third of respondents (34.3%) described their business as being in the same position today as they were at the start of 2022.

A plurality of small businesses surveyed said their business is now in a weaker position compared to where they were at the beginning of the year. 28.5% reported being in a weaker position, and 10.4% said they are now in a much weaker position. These businesses struggled to overcome the numerous challenges they faced this year.

With that said, a significant number of business owners did in fact make major progress in 2022. 21.2% reported being in stronger position now compared to the start of the year, and 5.6% said they are now in a much stronger position than where they began 2022.

2022: a year of mixed results

In summation, 2022 can be categorized as a mixed bag in terms of small business growth. While some business owners struggled to swim upstream against a variety of economic challenges, others found success despite those challenges.

This was part one of our survey results – in part two, we dive deeper into the story of small business funding in 2022 and share our thoughts on best options for small businesses in 2023.

📌 If you want to pursue funding for your small business, consider getting 1-1 help from Skip. You can book a free call to learn more about how we help members get funding and grow!