EIDL Funding Is Over But These SBA Funding Options May Actually Be Better

On Thursday May 5, SBA sources confirmed that the SBA EIDL program did not have any more available funding. While unclaimed funding may still become available, for most people in need of funding to start or grow their businesses, it's time to think about other funding options. The good news is there are other SBA programs that may actually be better than the EIDL program.

This post gives a comparison of SBA funding options. If you want to get help with any of these funding options — or other private funding for your business — you can book a time to talk with the Skip team.

It's Official — The SBA EIDL Program Has Run Out of Funding

Shortly after SBA sources confirmed that the EIDL program didn't have any "available" funding left, the SBA updated their EIDL portal with the following message:

"COVID-19 EIDL Funds have been exhausted... Respond to SBA requests for signature and documents by May 16. The failure to sign and submit documents prior to funds being exhausted/rescinded will result in no increase."

While the message is clear — no more EIDL funding — the last part of the message is also important: If there is unclaimed funding on May 16, it is probable that more increase approvals may happen.

Historically, there has been a pattern of unclaimed funding approvals being put back into the pot of money. A few weeks ago nearly $5B in extra funding became available when EIDL increase approval documents weren't signed in time.

Here's How The EIDL Program Stacks Up to Other SBA Funding Options

Despite the chance that some EIDL increase requests in the queue may eventually get approved, it's time for most small business owners to start seriously thinking about other options — before these get "discovered" by the masses.

First up, here's a quick comparison of how the EIDL program stacks up to the other major SBA programs. (Other SBA programs and private options we cover on the Skip blog).

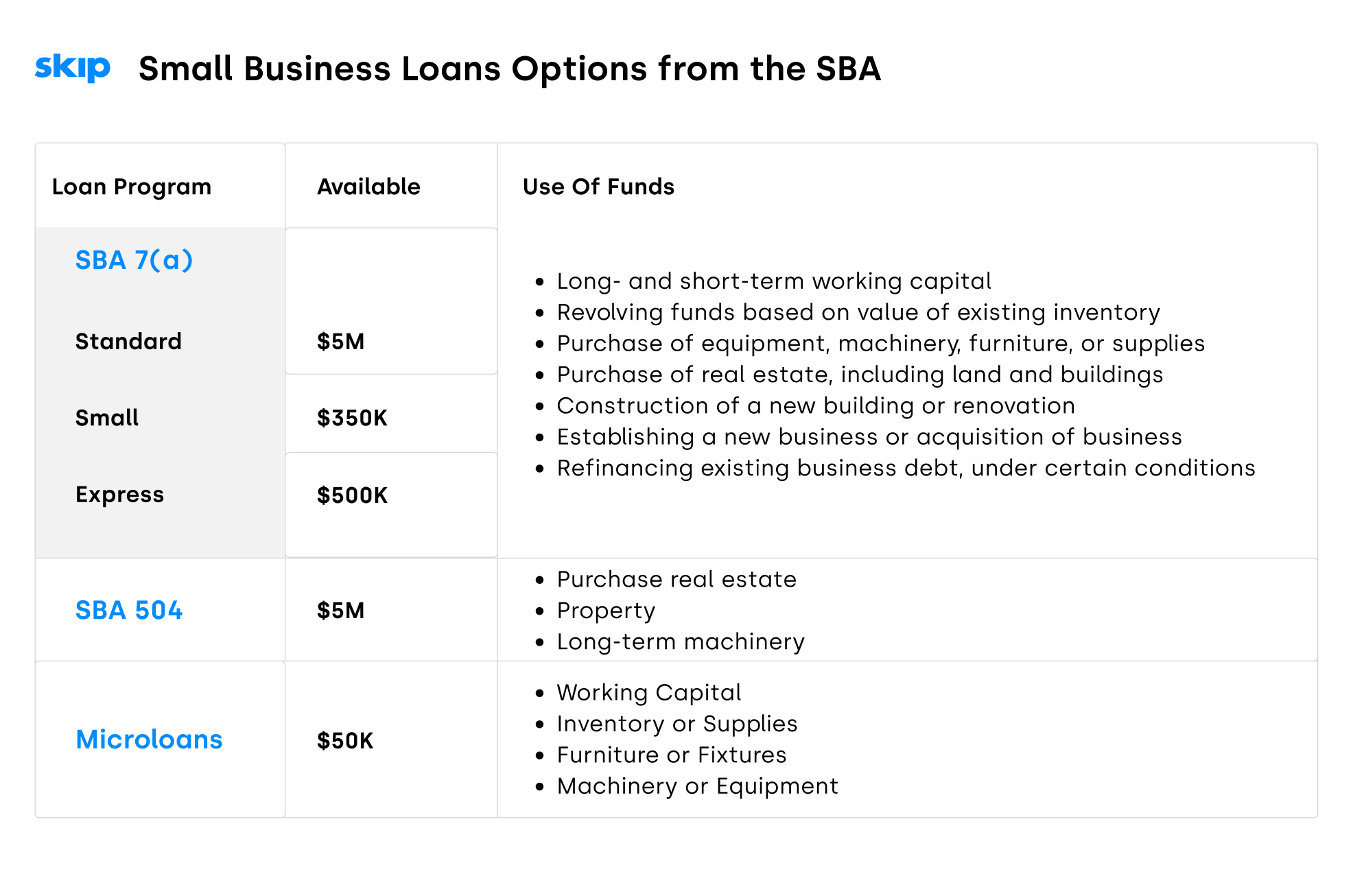

Depending on how much funding you need and what you need it for, SBA microloans and 7a loans are two of the most popular options. SBA microloans go up to $50K and SBA 7(a) and SBA 504 loans can be up to $5M.

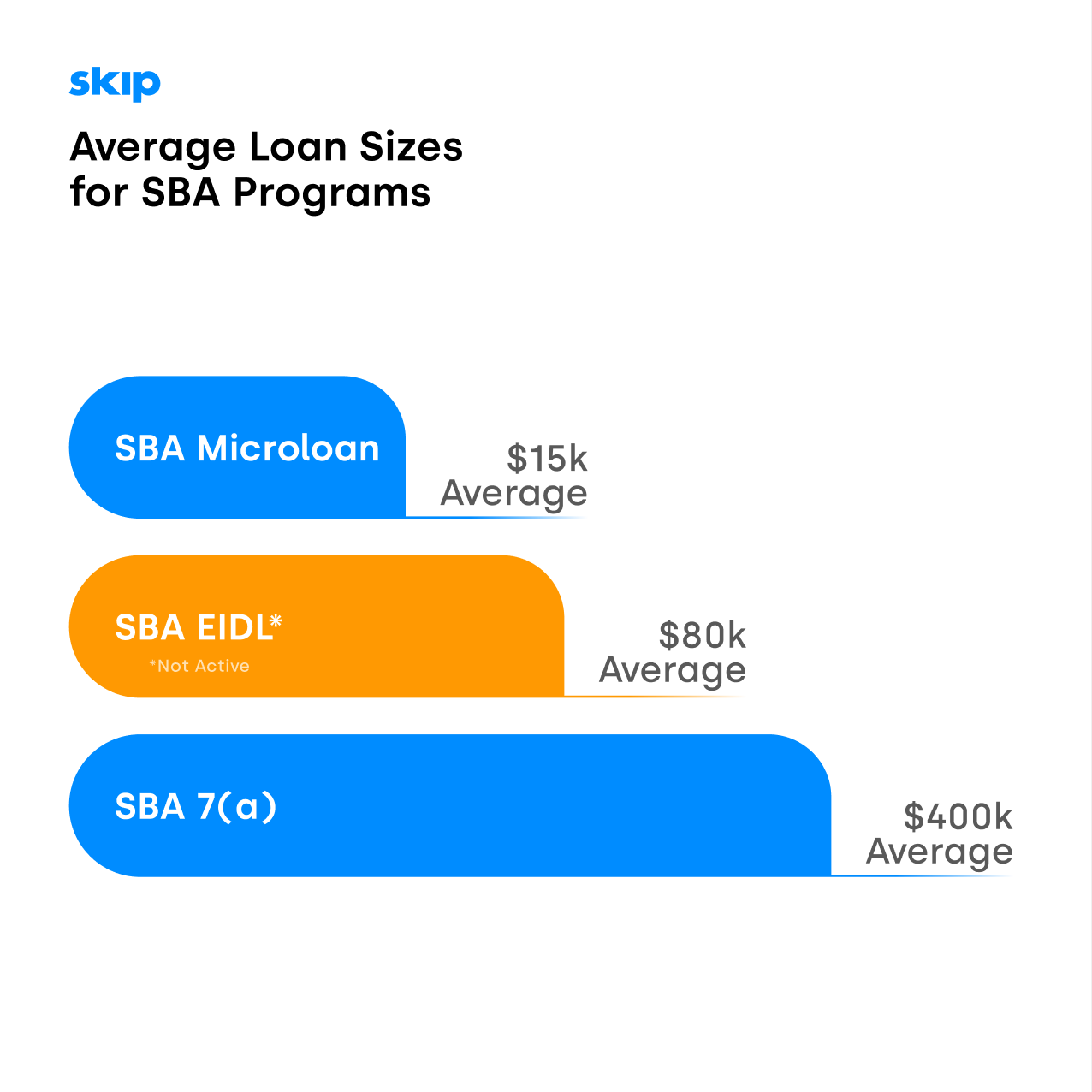

In fact, when we look at average loan sizes for these programs, it turns out that the SBA 7a program — which can be used broadly for working capital, purchasing of equipment, refinancing, or even starting or acquiring a business — has a higher average loan amount than SBA EIDL loans.

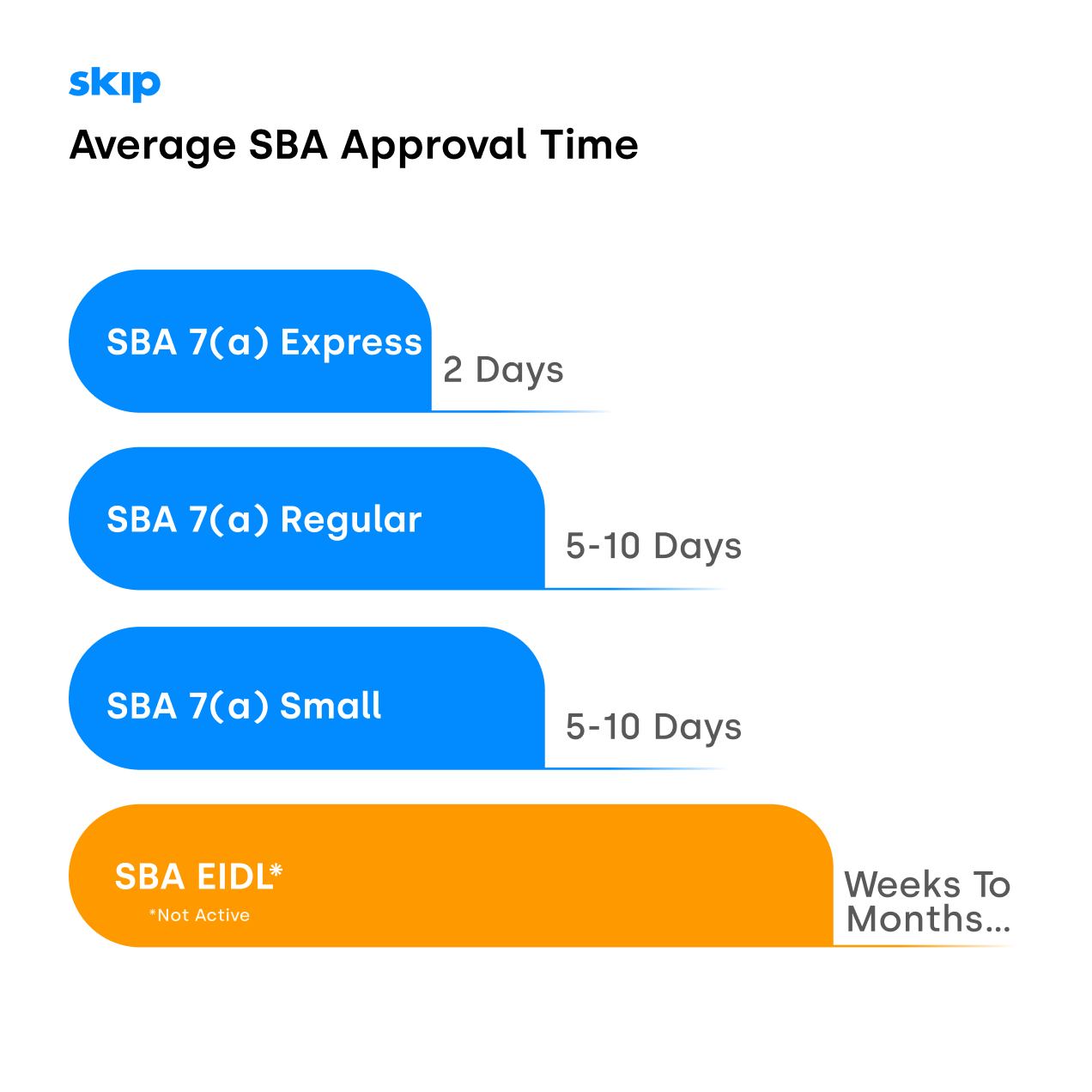

Finally — and perhaps one of the most important factors in deciding which programs to apply for — the average approval times for other SBA programs can be significantly lower than the SBA EIDL program. Actual times will vary by lender, but overall, the SBA 7A program can be much faster than the SBA EIDL.

Interested in Learning More About SBA EIDL Alternatives Such as SBA Microloans or SBA 7A Loans?

There's plenty of other funding options that in some regards can be better options than the SBA EIDL program. Just because the EIDL program funding has ended, doesn't mean you cannot get low-interest, long-term financing options to start or grow your business. If you want to find out more, you can always create a free Skip account here to read more of our posts and see other how-to videos. Alternatively, if you want to talk with our team and get help applying for these options, join Skip VIP today and get 1-1 support for your business.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.