EIN vs TIN — The Difference and Why It Matters

What’s the difference between an Employer Identification Number (EIN) and a Tax Identification Number (TIN)? If you thought they were the same, they’re not. An EIN is a TIN, but not the other way around.

In this article, you'll learn about how these tax IDs differ, who needs one or the other, and who doesn’t. We'll also show you where to apply for your tax identification numbers regardless of the category you fall within.

What are the Different Tax IDs?

Before delving into the particulars of EINs and TINs it's also important to understand the different types of Tax ID numbers. Essentially, an EIN and an SSN are both TINs, but not the other way around. —

- Social Security Number (SSN). The Social Security Administration (SSA) issues eight-digit SSNs to individual U.S. citizens, permanent residents, and eligible non-immigrant workers. If you work in the U.S., or abroad, this is the number used to report your earned income to the IRS.

- Employer Identification Number (EIN), or Federal Tax Identification Number (FEIN). Issued by the Internal Revenue Service, this nine-digit tax id is unique to your business and differentiates you from an individual taxpayer and other businesses.

- Taxpayer Identification Number (TIN), or Individual Taxpayer Identification Number (ITIN). A TIN can be issued by either the IRS or the Social Security Administration (SSA). They function as a social security number of sorts for those who are ineligible for SSNs.

What is an EIN?

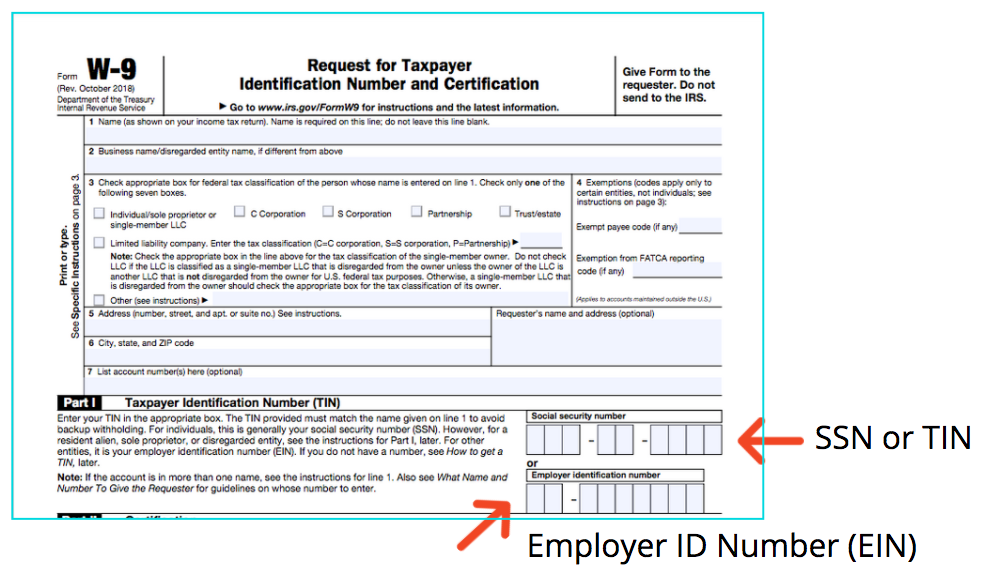

An EIN identifies your business at tax time. Unlike an eight-digit SSN, the EIN consists of nine digits and may include appended text denoting a particular type of business or group. This is the number employees, contractors, and vendors will use when filing their taxes as shown below:

What Is a TIN?

Tax Identification Numbers (TIN) are obtained from either the SSA or the IRS, and they function as a social security number of sorts — to govern and administer U.S. tax laws for those who are ineligible for SSNs.

Similar to SSNs given to American citizens, a TIN is a nine-digit number issued to businesses and non-U.S. residents. This string of numbers looks like a SSN, but will always start with the numeral 9. This is the number you'll enter in place of an SSN in the previous graphic.

Complete IRS Form SS-5, Application for Social Security Card to obtain a TIN.

What’s the Difference Between an EIN and TIN?

An EIN is a type of TIN (a generic term for a variety of tax identification numbers), the difference being an EIN is used to identify companies, while a TIN identifies taxable individuals who are ineligible for a Social Security number. These include visa holders, resident and non-resident aliens, and some independent contractors – to name a few.

Who Needs an EIN?

You’ll need an EIN to open a business bank account, pay your employees, or apply for any required licenses. The following types of business entities are required to use their EIN when filing business tax returns:

- Corporations

- Employers

- Estates of Decedents/Trusts

- Government agencies

- Non-profits

- Partnerships

- Some sole proprietors

Who Doesn’t Need an EIN?

LLCs and sole proprietors who don’t have employees do not need an EIN since income for these types of businesses passes through to their personal tax returns, using an SSN for tax purposes.

Are There Benefits of Obtaining an EIN?

Your business is protected from identity theft through this unique number and an EIN can help you avoid tax penalties.

Moreover, your unique EIN lends credibility to your business, helps towards building trust with vendors, and enables you to hire employees. Lastly, an EIN is instrumental in establishing business credit to facilitate future funding.

How Do You Get an EIN?

Once you’ve registered your business entity with your Secretary of State, you can submit your application with the Internal Revenue Service (IRS). It’s easy and free to apply online or complete form SS-4 and fax to:

Internal Revenue Service

FAX: 855-641-6935

Attn: EIN Operation

Cincinnati, OH 45999

Who Needs a TIN?

You will need a TIN if you are ineligible for obtaining an SSN and work or do business in the U.S. You’ll need to validate your necessity for obtaining a TIN and you belong to one of the following categories:

- Non-resident alien required to file taxes in the US

- Resident alien required to pay U.S. taxes based on length of stay/days based within the country

- Spouse or dependents of non-resident visa holders

- Non-resident alien claiming tax treaty benefits

- Non-resident alien researcher, professor, or student who files a U.S. tax return, or claims a tax exemption

These include, but are not limited to the following visa types:

- E2-Visa

- L1-Visa

- OPT-Visa

- TN-Visa taxes

- And, some independent contractors

This is only a partial list, so it’s incumbent upon visa holders to understand what your visa status is and how it can affect you at tax time.

How Do You Get a TIN

To get your TIN, complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number, provide substantiating documentation of foreign or resident status, along with official identification documents.

By Mail. Mail IRS Form W-7 with all required documentation to:

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, Texas 78714-9342

In Person. You can take your completed W-7 form to a local Acceptance Agent. Acceptance Agents are authorized to review documents and forward the completed forms to the IRS for final processing. You can find Acceptance Agents throughout the U.S., at local and regional accounting firms, financial institutions, or even nearby colleges. Learn more about obtaining a TIN from the IRS’s FAQ page.

How Else Can Skip Help? Whether you need assistance navigating funding for your small business — like SBA loans, grants, or other financing options, or guidance with government-related services — like TSA PreCheck or DMV appointments, we’re ready to help. Become a member and skip the red tape.