Debt to Equity Ratio (D/E): What Is It and How to Calculate It

If you’ve heard the term “highly leveraged” and didn’t quite understand what it meant, you’re not alone. It’s another term for a Debt to Equity (D/E) Ratio (also known as the debt-equity ratio, risk ratio, or gearing). It demonstrates how much a business is financed through borrowing, as opposed to wholly-owned funds.

In this article, we’ll explain what the D/E ratio is, how it’s calculated, and how banks use D/E ratios to determine risk when making business loans. We’ll also describe what a good D/E ratio is, and why debt capital isn’t always a bad thing. Lastly, some tips on improving your D/E ratio, as well as links to reputable lenders specializing in business and corporate financing.

What is a Debt to Equity Ratio?

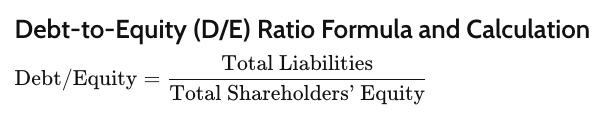

A D/E ratio is a simple formula that takes the company’s total liabilities (what the company owes/debt) and divides them by total shareholder equity (what the company owns/assets). It is a measure of how much a business is financed through borrowing, as opposed to wholly owned funds. Oddly enough, D/E ratios are never presented as percentages.

How Do You Calculate Debt to Equity Ratios?

Here’s a couple real-world examples of D/E ratios.

Company 1 shows $100K in total liabilities (debt) on its balance sheet, and only $20K in shareholder equity (retained earnings or assets).

Using the D/E ratio formula equation, Company 1’s D/E ratio is 5. Meaning for every dollar the company earns, it owes $5 to lenders or creditors. Banks consider this high D/E ratio as a very risky loan, with unlikely odds for approval.

Company 2 is carrying $50K in liabilities (debt) on their balance sheet, and $100K in shareholder equity.

Their D/E ratio is .5. Meaning for every dollar they owe, they earn $5. A bank sees a healthy balance sheet with good debt capital as a low-risk business loan, with a high likelihood of approval.

What is a Good Debt to Equity Ratio?

Although there are parameters, a good D/E ratio may vary from one industry to another. In general, a “reasonable” D/E ratio, e.g. not too low and not too high is where you want to be. Lenders look at the entirety of a company’s balance sheet to determine overall creditworthiness.

A higher D/E ratio may not always be an indicator of high risk. High D/E ratios in one industry could simply mean that a company is using its debt capital to grow its business.

Debt isn’t always bad. Investors and analysts like it when a company uses debt wisely. Industries like transportation and utilities tend to carry higher D/E ratios due to their investments in large capital projects.

Moreover, banks and other lenders find these higher ratios acceptable for a business with solid cash flow—but not for one in financial decline.

Conversely, if your company’s D/E ratio is too low, it can show you’re financing your business on equity, instead of employing debt capital, which is costly in the long term. Very low D/E ratios can also put a business in jeopardy for a leveraged buyout.

How Do Debt to Equity Ratios Affect My Ability to Borrow?

Businesses have several ways to fund themselves, borrow from lenders or investors, or equity. Investors expect to see significant returns on their investments, while banks look at the D/E as an indicator of cash flow, revenue generation, and profitability. Both will compare this data with similar businesses or industries to evaluate potential risks—or benefits.

How Can You Improve Your Debt to Equity Score?

If you find yourself in a position where your D/E score is on the higher end, there are ways to balance it out and improve your score.

Pay Down Debt

Start by paying down your company debt. If you’re paying your creditors on a payment plan, consider paying more towards the principal (just like a mortgage) to reduce the overall interest and shorten the timeline—unless there are prepayment penalties.

Reduce Your Bill-to-Balance Ratio

Work on ridding your business of debt with the highest Bill-to-Balance ratio. For example, you have two business loans, Loan 1 for $250K and Loan 2 for $200K. Your fixed monthly payment on Loan 1 is $1200 per month, while Loan 2 is $1800. You would pay the higher loan payment down first to lower your bill-to-balance ratio.

Renegotiate Loans

Talk to your lender about renegotiating or consolidating your loan(s) into one with better terms.

Need Help With Business Funding?

Funding Circle and Fora Financial are online lenders that offer a variety of options. Online lenders are often able to fund business loans quicker than traditional lenders can, which makes them attractive options for businesses that need capital fast.

How Else Can Skip Help? Whether you need help navigating small business funding–like SBA loans, grants, or other financing options–or help with other government-related services–like TSA PreCheck or DMV appointments—Skip the red tape with Skip.