Cryptocurrency: The Future of Finance or a Failure Waiting to Happen?

Cryptocurrency has only been around for the last ten years, yet it has become a trillion-dollar industry. Some of the older millennials and baby boomers are allocating part of their investment portfolio to cryptocurrency but it is vastly popular and preferred by younger millennials and Gen Zers. Many are keeping cryptocurrency at arm's length, saying it's too volatile. There is a lot to understand with cryptocurrency. This article will explain the basics and why it is preferred by Gen Z.

What Is Cryptocurrency?

To put it simply, cryptocurrency (frequently referred to as crypto) is a digital or virtual currency. It is secured by a process called cryptography. Cryptography is an advanced computer-generated process that converts text or data into scrambled jargon. The purpose is to make data unreadable. The data is then unscrambled for the intended reader. Many companies have their form of crypto, usually called tokens, that can be traded or used to purchase a service or good provided by the company. Tokens are exchanged for real currency.

For example, let's say you purchase $1,000 worth of tokens from a crypto provider. In return for your $1,000 investment, you would get tokens equal to $1,000. These tokens can then be used to buy items from that company, purchase items from other companies that accept cryptocurrency or hold onto it in the hopes that the value appreciates. Some of the most popular types of crypto are Bitcoin, Ethereum, and Dogecoin.

Cryptocurrency uses a technology called blockchain technology. Originally used to timestamp digital documents, it was revolutionized by Satoshi Nakamoto in the production of Bitcoin. Simply put, it's a data storage system similar to a database. Unlike a database where information is simply housed, blockchain technology links "blocks" of information to one another in a particular order. If any of the information in any of the blocks is tampered with, it sets off a chain reaction that notifies every holder of the blocks, which in turn automatically denies the tampering.

Since cryptocurrencies work off decentralized peer-to-peer networks, everyone has access to the same blockchain. If someone tampers with any block of information, the entire system is notified and verified against itself. Therefore, in order to tamper with the system, someone would essentially need to hack over 50% of the user accounts simultaneously and change the data on every account at the same time. This why blockchain technology is considered to be very secure.

Why Is It Popular?

Crypto is popular for a few reasons. First off, many see crypto as the currency of the future. As the global market becomes more and more entangled, it makes more and more sense to investors to have a global currency. Companies that accept cryptocurrency accept it from anyone. A Bitcoin or Dogecoin in the United States is worth the same amount as a Bitcoin or Dogecoin in Zambia. Many like the fact that they can send crypto to anyone in the world and the value stays the same.

Secondly, it removes the middle man. When you pay for an item with a token, or you send tokens to someone you know, it goes directly from your digital account to their digital account in seconds. This removes the banking system from the transaction, along with heavy fees that are generally associated with wire transfers. It puts control firmly in the hands of the user. Also, the younger generation likes having more control over their investment that other options don't offer.

A third reason it is becoming popular, especially with the younger generation, is the technology. Many Gen Zers are investing in cryptocurrency because of blockchain technology. CNBC recently published an article with several Gen Zers stating that the technology is the reason they are investing in crypto, even if they lose money.

Lastly, crypto is popular because various currencies have increased in value 10 times, 100 times, and even over 1,000 times. Bitcoin went from a few thousand dollars in value to over $600 billion in value. Some have become millionaires simply by investing when a single coin was worth 1/1000th of a cent, that's now worth five cents per coin. The investment return can be staggering high.

What Are the Concerns?

Despite its growing popularity, many are still very skeptical. Many do not see cryptocurrencies as a real investments because they are generally backed by other users. For someone to make a profit, others must invest in the same coin at a higher price. For example, if you purchase one coin for $1 and everybody else buys the coin for $1, then nobody makes money. Using your cryptocurrency essentially becomes no different from using your debit card. But, if you buy a coin for $1 then the price is raised to $5, your investment appreciates. That's how the industry fundamentally works.

Many reputable investors and financiers have told would-be crypto investors to stay clear of them. Warren Buffet compared Bitcoin to paper checks. He said Bitcoin was "a very effective way of transmitting money...Are checks worth a whole lot of money? Just because they can transmit money?" Billionaire Mark Cuban said he would rather have bananas than crypto because at least he can eat bananas. He said crypto is at best "stored value."

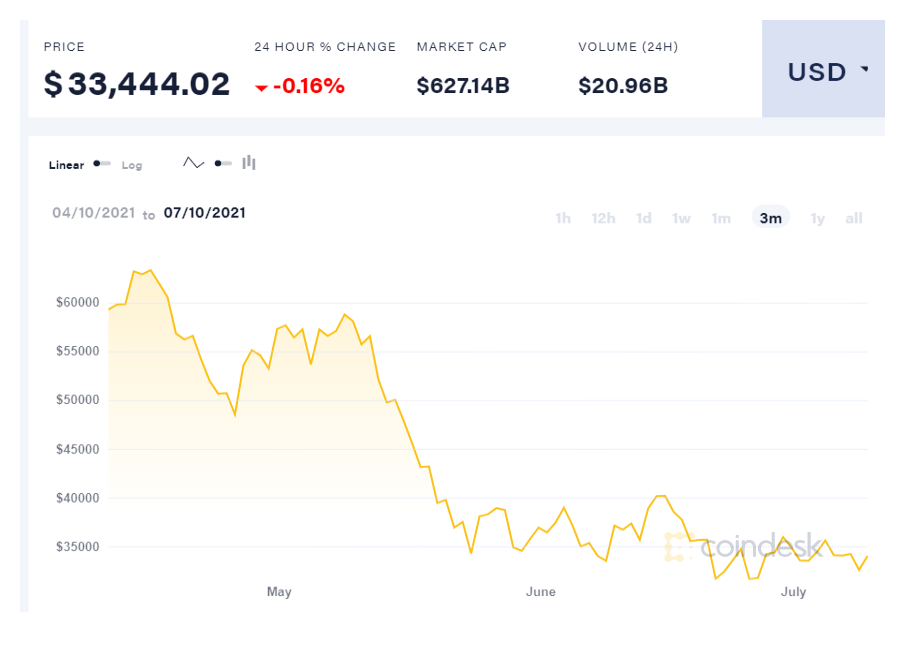

Crypto is notoriously volatile as well. Bitcoin's prices have risen and fallen by tens of thousands of dollars per share over the last few years. Bitcoin nearly reached $65,000 this April before crashing down to $34,000 in May and just under $32,000 in June (see graph below). Others are likening Tether, another cryptocurrency, to a Ponzi scheme that could crumble at any moment.

Cryptocurrency Take-Aways

Cryptocurrency is a very popular industry. There are over 10,000 publicly traded cryptocurrencies on the market today. The top five companies alone have a combined worth of over $1 trillion. It is popular with Gen Z because it gives them more control over their investment, unlike traditional investment options. They also value the blockchain technology that runs the crypto world.

The potential for financial gain is certainly there, but many say it's too good to be true. Mark Cuban said that anyone who is thinking about investing in crypto is doing so at their own risk, and advises never to invest in more than you can lose. If crypto is something that you want to invest in, we advise that you conduct your own research, speak with an advisor, and never invest more than you can afford to lose.

Disclaimer: Skip is not advocating for or against the investment in Cryptocurrencies. This article is intended to provide information about Cryptocurrency and should not be used or received as financial guidance. Always consult a financial adviser when making investments in any company, including cryptocurrencies.